NVCA 2020 Yearbook: 10 Trends to Watch for the Start of a New Decade

NVCA 2020 Yearbook, highlights trends and analysis of VC activity in the U.S. from the past year and capturing historical data and information about venture’s role in fueling entrepreneurship in America.

The main idea: The Yearbook hights ten notable stats and trends that could have an impact on the U.S. venture capital industry.

We recently released the NVCA 2020 Yearbook, highlighting trends and analysis of venture capital (VC) activity in the US from the past year and capturing historical data and information about venture’s role in fueling entrepreneurship in America.

We completed the copy for the Yearbook just before COVID-19 began to rock the country, throwing our economy and public health systems into chaos and uncertainty. And while the current macro chaos has short- and long-term effects on the venture ecosystem, it doesn’t change some of the important trends the Yearbook surfaced from the past year and decade that may offer insights into what to expect at the rocky start of this new decade.

Here are 10 notable stats and trends on the US venture capital industry from the Yearbook. H/T to PitchBook for providing the data.

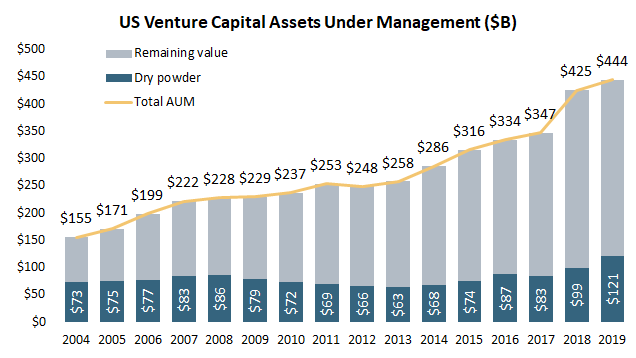

1. Number of VC firms & AUM: At the end of 2019, there were 1,328 VC firms in existence1, managing 2,211 active VC funds, translating to $444 billion in US VC assets under management (AUM). VC investors started 2020 with $121 billion in dry powder to deploy to promising startups. All four of these stats represent record highs.

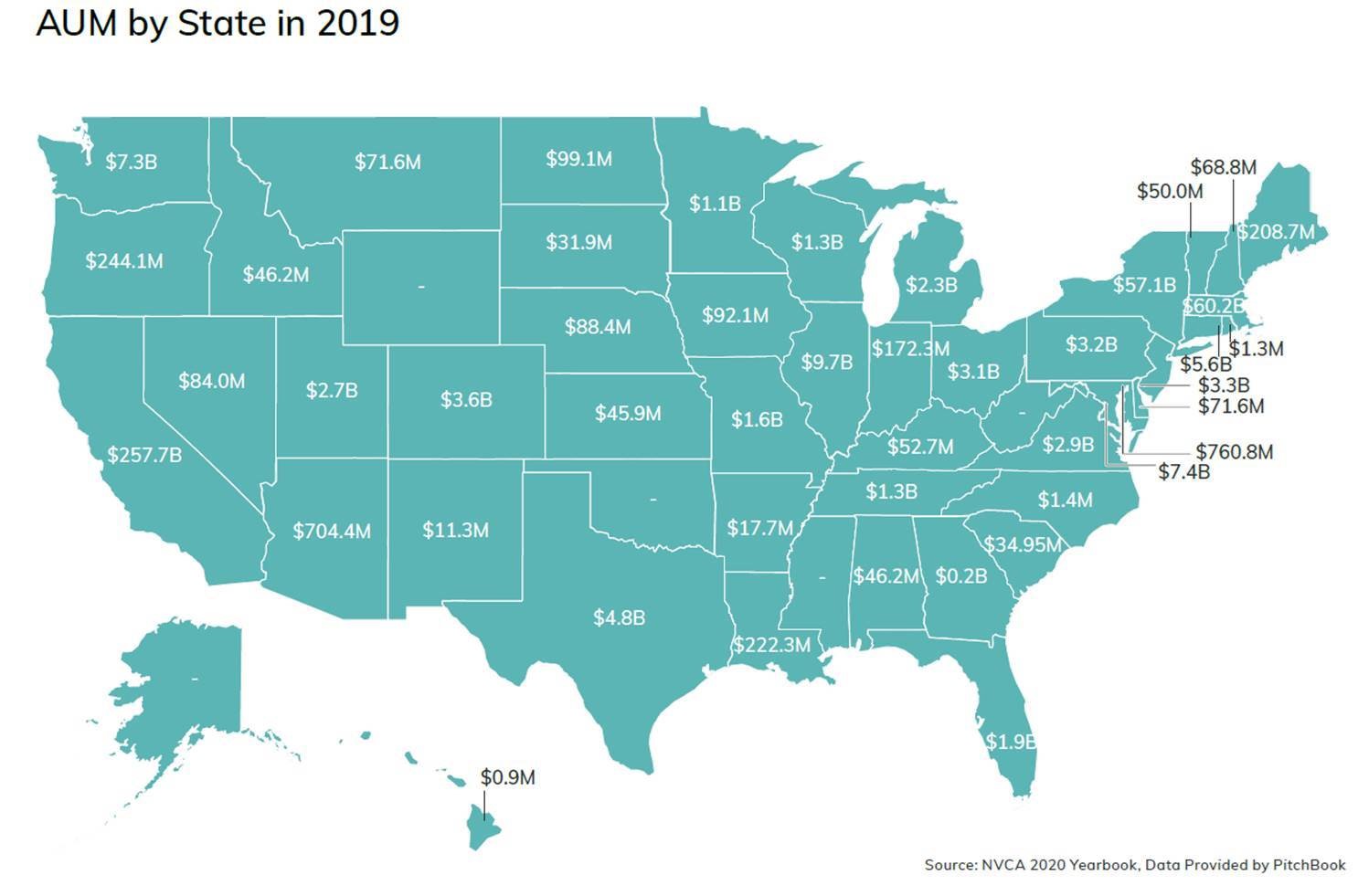

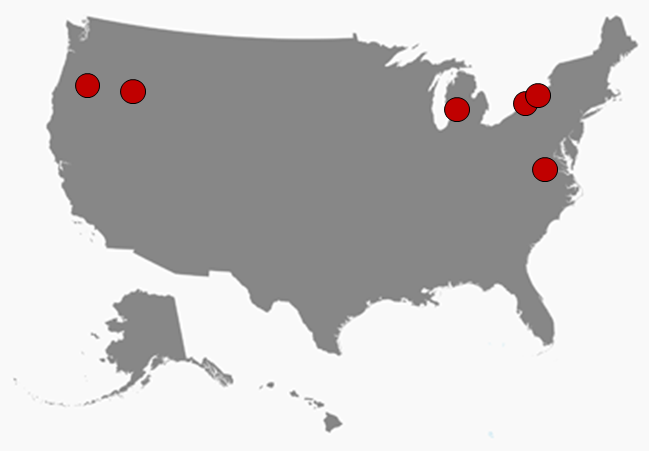

2. VC AUM across the country: Three states—California, Massachusetts, and New York—continue to comprise a majority, or 84%, of US venture capital AUM. Those three states saw slight AUM increases year-over-year. However, Iowa, Ohio, the District of Columbia, and Minnesota saw the highest year-over-year increases in VC AUM. At the start of 2020, 28 states had $100 million or more in VC AUM.

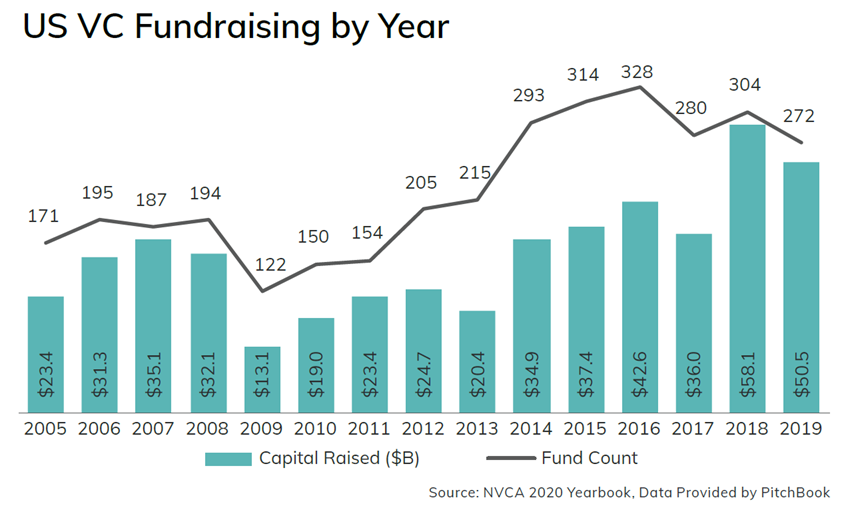

3. Six strong years of VC fundraising – The record VC AUM and dry powder have been driven by six consecutive years of $35 billion or more raised by VC funds. Heightened fundraising levels brought the median VC fund size in 2019 to $80 million, the highest since 2008. Outside of the traditional VC hubs of California, Massachusetts, and New York, the median VC fund size hit $43 million (a 57% increase compared with 2018) but is still much smaller than the $100 million median VC fund size for those three states collectively.

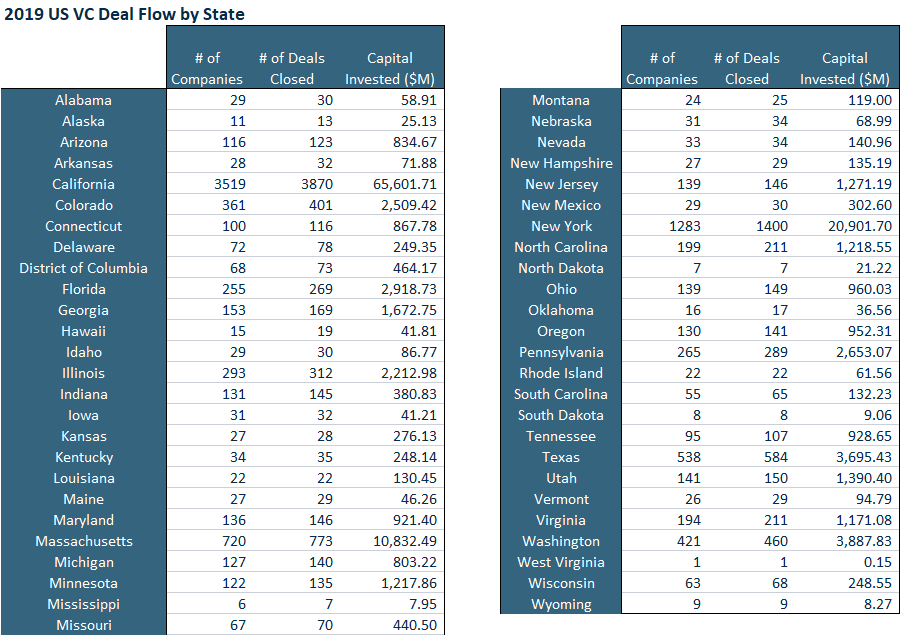

4. Promising startups are all across the country – VC funding reached startups in all 50 states and the District of Columbia, 242 Metropolitan Statistical Areas (MSAs), and 397 Congressional Districts in 2019. Capital invested remained concentrated in California, Massachusetts, and New York, which together attracted 73% of total US VC dollars invested. However, startups in the rest of the country (i.e., outside CA+MA+NY) attracted 53% of the total US VC deal count.

5. Notable growth for MSAs outside traditional VC hotbeds – Buffalo, NY, Boise City, ID, and Richmond, VA saw the biggest growth rate (CAGR) for annual number of VC investments over the past five years (for those MSAs with at least 15 in 2019). Bend, OR, Rochester, NY, and Grand Rapids, MI saw the largest annual growth (CAGR) for VC capital invested over the past five years (for those MSAs with at least $10 million in VC investment in 2014 and 2019).

6. US venture-backed startups represent millions of jobs – Startups that were venture-backed in 2019 represented approximately 2.27 million2 employees.

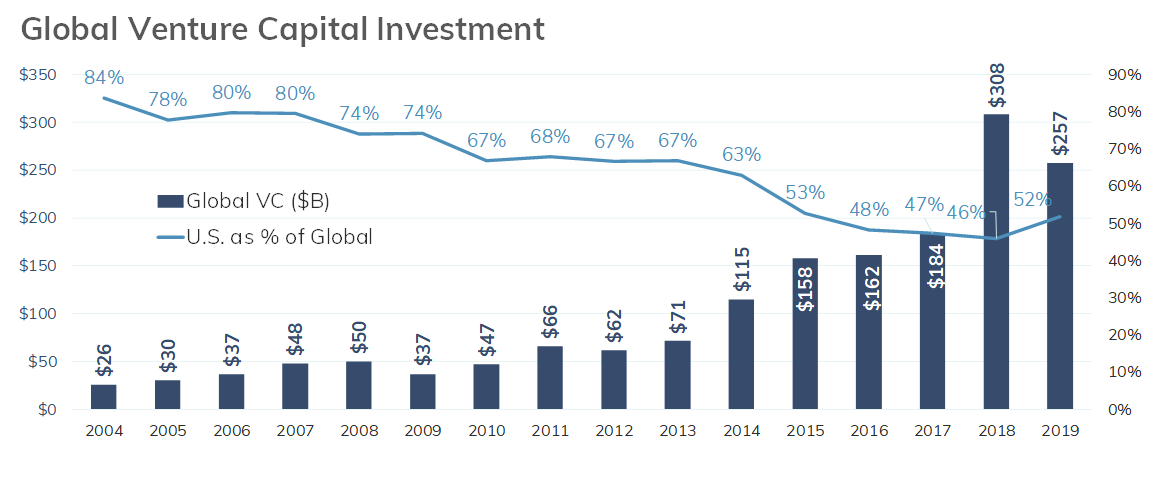

7. US share of annual global VC investment remains steady at around 50% – Globally, startups raised $257 billion across 23,268 deals in 2019, a 17% and 2% year-over-year decline, respectively. The US represented 52% and 49% of the global total, respectively. In comparison, the US share of annual global VC dollars invested was 84% in 2004 and 90%+ in the 1990s.

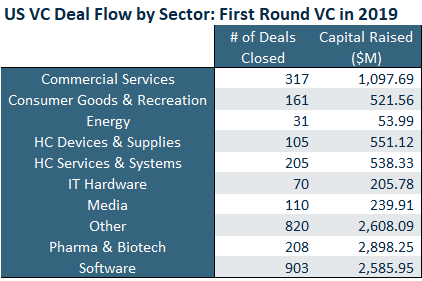

8. Pharma & biotech companies lead first-time financings – 2,729 US companies raised first-time funding3 and attracted $11.3 billion across all sectors in 2019, the second-highest annual amount of capital invested on record. The life sciences4 sector attracted 31% of total capital invested via first-time financings. Pharma & biotech companies (a subset of life sciences) attracted $2.9 billion in first-time financings, the highest among sub-sectors last year.

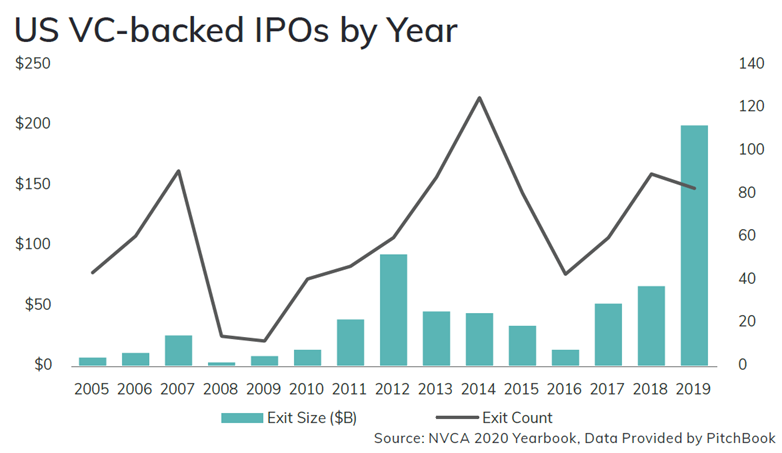

9. 2019 saw record exit value generated primarily by big IPOs – 82 venture-backed IPOs representing $199 billion in exit value in 2019 marked the highest annual exit value on record for the industry. These 82 venture-backed IPOs collectively had a post-money valuation of $223 billion, stemming from just $35 billion in venture investment prior to IPO.

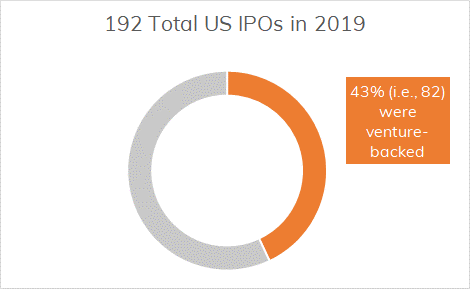

10. Venture-backed companies remain a force on the US public markets – Venture-backed companies accounted for 43% of all US IPOs in 2019. In fact, VC-backed companies comprised 42% of all public US companies founded from 1974 to 2015. At the end of 2019, the five largest publicly traded companies by market capitalization in the US—Apple, Microsoft, Alphabet, Amazon, and Facebook—were venture-backed before going public.

Read more in the NVCA 2020 Yearbook report or access the public data pack. NVCA members receive exclusive access to the XLS data pack by contacting research@nvca.org. Not an NVCA member? Contact membership@nvca.org to learn more.

Footnotes

1 Defined as those firms who have raised a fund in the last eight years.

2 Based on PitchBook’s custom estimation methodology for number of employees at venture-backed companies in the US. Data is as of early November 2019.

3 First round of equity funding in a startup by an institutional venture investor.

4 Life sciences includes Pharma & Biotech plus HC Devices & Supplies.

Maryam serves as Executive Director of Venture Forward, NVCA’s 501(c)(3) nonprofit supporting organization focused on shaping the future of venture capital.

Before transitioning to launch and lead Venture Forward, Maryam was the Senior Vice President of Industry Advancement at NVCA, where she led NVCA’s initiatives focused on advancing the venture industry – research and data, education, and diversity and inclusion, and incubated several Venture Forward initiatives.