Building Better: At One Ventures and Ascend Elements

Welcome to the NVCA Blog series, Building Better, where we celebrate the dynamic relationship between our VC members and their innovative portfolio companies around the nation. For today’s Building Better, we spoke to Laurie Menoud, Founding Partner of At One Ventures & Mike O’Kronley, CEO of Ascend Elements.

At One Ventures

Give us some background on At One Ventures: How did the firm start, what is your mission and how does the firm strive to meet its goals?

At One Ventures was founded in 2020, when Tom (Chi) and I realized that the fastest way to solve the climate crisis was to reset the industries that are causing the most damage to the planet – and the best way to do that is to back deep tech companies with entirely new ways to produce what our economy needs to thrive.

Specifically, we back early-stage ventures with 1) a disruptive deep tech that ushers in 2) radically better unit economics, paired with 3) radically better environmental economics.

Our investment strategy is anchored in physics fundamentals: matter, energy, time, and space. Breakthroughs or efficiencies in these areas naturally drive significant cost efficiencies in production, thus making the alternative an economical and more effective option.

That’s how we can create massive shifts in legacy industries like steel, construction, commercial buildings, and agriculture, for instance. By lowering adoption friction through unit economics with cost superiority, these industries can upgrade their production to be more profitable while becoming more aligned with planetary health.

Our mission is to catalyze a world where humanity is a net positive to nature – and this is our approach to meet that goal.

What does At One Ventures look for in a partner when choosing to invest in an company? What does At One value? What do you especially value in the Ascend Elements team?

While we categorize by traditional climate technology sectors, our mission is broader than most climate funds. We look to upgrade our relationship with the components of nature – Air, Water, Soil, and Biodiversity – and assess what we call the “Total Addressable (positive) Impact” (TAI) our portfolio companies have on each of these components.

We are not looking at incremental solutions that can improve things by 10% or 20% but solutions that can completely reset industries by producing what we need while giving back to the planet.

For our seed-stage and Series A companies, we look for deep tech at the late lab bench stage, when the science has been fully derisked, and only engineering and scale-up risks remain. We also look for superior unit economics from the physics fundamentals of the technology and, finally, a strong founding team with both technical and industry expertise with an inherent ability to attract the best talents.

Take the EV industry. We are shifting from a fuel economy to a materials economy. Each electric vehicle requires over 100kg of mined metals in its battery pack. This demand puts pressure on the mining industry, bringing social and environmental challenges.

That’s why we invested in Ascend Elements, an advanced materials company that recycles end-of-life lithium-ion batteries and reintegrates the recycled metals directly into EV batteries. With stronger unit economics and similar cathode material performances, they make it an obvious choice for EV automakers to adopt the solution, driving faster positive environmental impact.

And their team was just the best! Strong technical background in cathode chemistry, coupled with veterans from the automotive and battery manufacturing industries, and joined by experts in large manufacturing plant construction and operation.

How does At One VC support its portfolio companies? How does it help entrepreneurs grow and advance the VC industry?

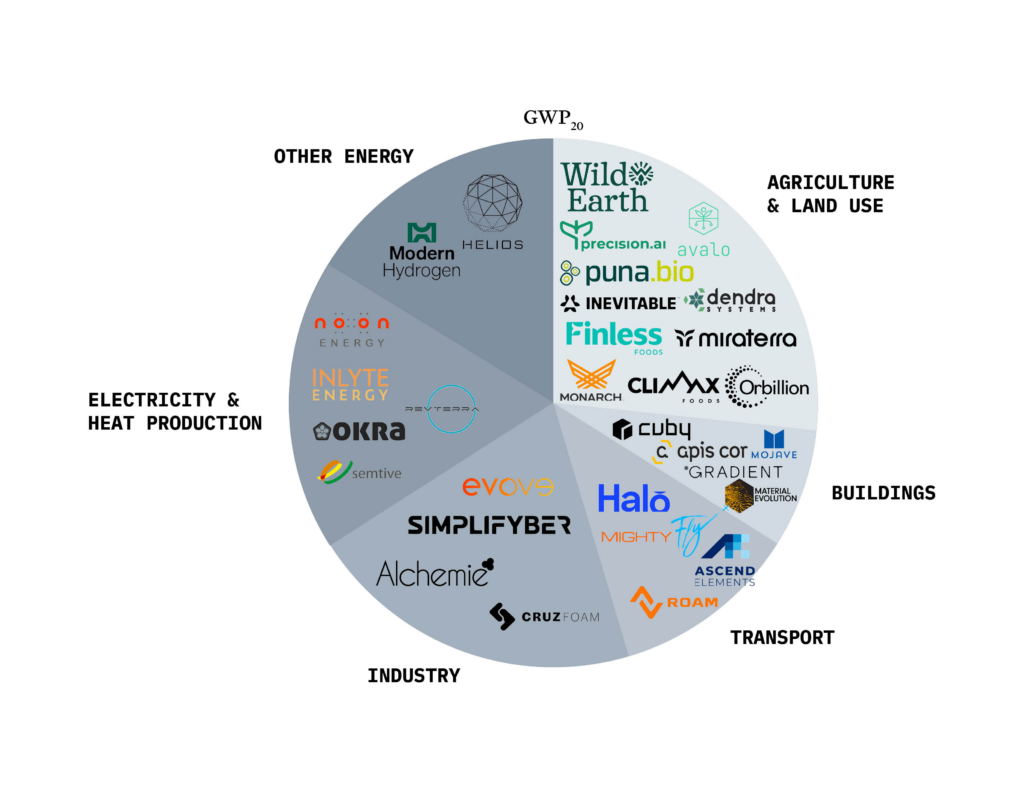

Since 2020, we have invested in 35 startups, pre-revenue at the time of our investment, and out of those, nearly one-third are already with recurring revenue or booked sales as of today. We think that says a lot about how we support our companies – we help them scale and bring their solution to market, driving faster positive environmental impact.

Our investment team has backgrounds in physical sciences, engineering, manufacturing, and finance and is not only well-positioned to evaluate physical/hardware businesses but also to have a detailed and disciplined understanding of what it will take to commercialize that technology and successfully displace existing brownfield industries.

And, over the past year, we’ve built out our platform team as well. Our head of talent brings the highest qualified people to fill roles at the critical early building stage. Our head of marketing works with the founders on their GTM, marketing, and sales strategies, as well as PR and communications.

We’ve built a team of experts in manufacturing to scale up production, set up supply chain, and optimize costs. We have someone who supports the companies with patent writing and strategy. Our investment operations leader ensures that our companies are fully supported as they raise further rounds, which in this macroeconomic climate can be pretty challenging without hands-on assistance from your earlier investors.

Q&A with Ascend Elements

What is the mission of your company and how did you start?

Ascend Elements is on a mission to accelerate the global transition to zero carbon emissions. The company does this with an ultra-efficient, patented process (Hydro-to-Cathode®) to recycle lithium-ion batteries and manufacture sustainable engineered cathode precursor (pCAM) and cathode active material (CAM) to power a new generation of cleaner electric vehicles. The Hydro-to-Cathode recycling and cathode manufacturing process can reduce carbon emissions by up to 93% compared to traditional methods. Ascend’s recycling technology recovers 98% of the critical metals in used lithium-ion batteries and will offset the need for mining.

Ascend Elements was founded in 2015, but work on the company’s core technology began at Worcester Polytechnic Institute in 2011. Co-founders Prof. Yan Wang and Dr. Eric Gratz started developing the Hydro-to-Cathode® direct precursor synthesis process in 2011 and filed the first patents on this technology in 2012. The company was originally founded as Battery Resourcers, but changed its name to Ascend Elements in January 2022.

Where and how is your company looking to grow into the next 5 years?

Ascend Elements is focused on producing sustainable, engineered battery materials for electric vehicles in North America and Europe. The company aims to recycle domestic lithium-ion battery material and return the valuable cathode material back to the domestic supply chain. The primary focus is building a 140-acre cathode manufacturing campus in Hopkinsville, KY. When complete, this facility will produce enough cathode precursor for 750,000 EVs per year.

Additionally, the company recently announced a joint venture with SK ecoplant and will jointly build a new EV battery recycling facility in Kentucky. Additional recycling facilities may be built in the United States and Europe in the coming years.

What problem is your company trying to solve?

Ascend Elements is helping to prepare for the tsunami of retired and end-of-life EV batteries that is expected in the coming decade. By unlocking the full value of used EV batteries and improving the economic return on recycling, Ascend Elements’ innovative technology may be the best way to increase recycling rates and keep potentially hazardous battery materials out of landfills. The Ascend Elements process also creates a truly closed-loop source of new battery materials, minimizing the need to mine nickel, cobalt and lithium.

Concerns about the sustainability and environmental impact of electric vehicles is a major concern for many people considering an EV purchase. Mining for cobalt, nickel and lithium can have significant environmental, safety and social justice impacts. Unsafe work conditions and child labor have been associated with mining operations in central Africa. Additionally, mining is an energy intensive activity that generates significant greenhouse gas emissions. Sourcing critical battery metals via recycling or “urban mining” is far more environmentally friendly, socially just and energy efficient.

How has At One impacted your company’s future for the better?

At One Ventures was an early investor in Ascend Elements, providing both capital as well as strategic guidance and support. This is a capital intensive business, so equity investments are vitally important, but strategic guidance and partnership is priceless to any startup. Laurie Menoud of At One Ventures has served on the company’s board of directors and played an instrumental role in the growth of Ascend Elements.