CVCs Committed To Remaining Active Amid COVID-19

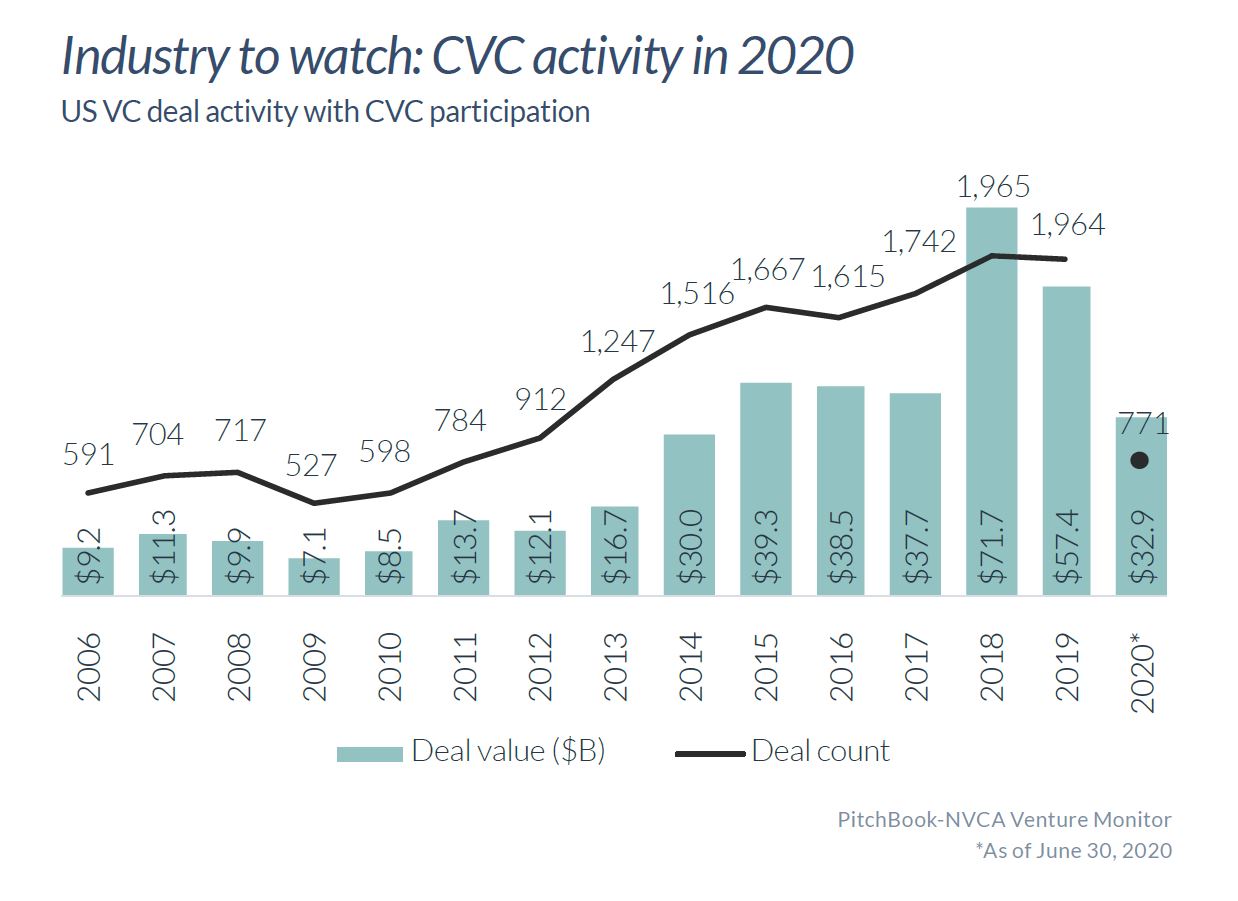

Corporate venture capital (CVC) investment was resilient in Q2 2020 even as venture activity overall fell. Through Q2, CVC invested nearly $33 billion, which means CVC is on pace to surpass 2019 investment and may even exceed 2018’s impressive figures.

2020 has been a turbulent and unprecedented year. But startups have benefited from corporate venture capital (CVC) activity, and CVC will help the country on the road to economic recovery.

Many would expect that if deal activity falls across the venture capital industry due to an economic downturn or other developments, deal activity with CVC participation will likely follow suit. However, CVC investment was resilient in Q2 2020 even as venture activity overall fell. Through Q2, CVC invested nearly $33 billion, which means CVC is on pace to surpass 2019 investment and may even exceed 2018’s impressive figures.

In particular, CVC investment in healthcare has been especially strong during the COVID-19 pandemic, and CVC investment in private-backed pharma and biotech companies is pacing for a new record in 2020. CVC is helping to confront the challenges our country is facing with COVID -19, having invested in companies that are pivoting or ramping up their efforts to combat this global pandemic.

CVCs reaction to the current economic downturn is different than it was in 2008

Over the last several months, comparisons have frequently been made between the 2008 financial crisis and the crisis at hand. Similar to the present moment, 2008 created economic fears and uncertainties. CVC activity declined significantly during the 2008 crisis, as many corporate venture capitalists became increasingly skeptical of making investments at such a volatile time (Figure 1). That said, during the 2008 crisis, new CVCs were established, many of today’s “unicorns” were founded (Airbnb, Github, Okta, Square, Twilio, Uber, and others), and iPhones began to trickle into society’s grasp, creating an inflection point for technology. These factors created an opportunity for innovation.

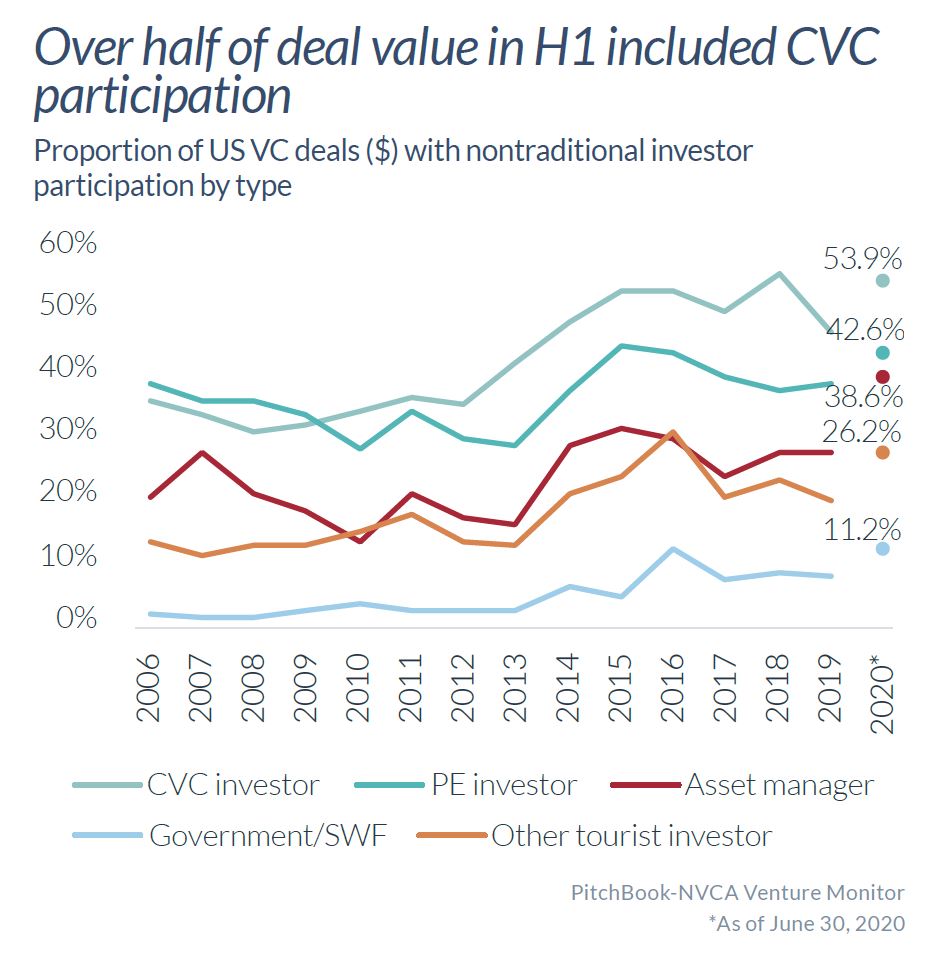

Today, many CVCs have doubled down on remaining engaged in the venture ecosystem as the economic cycle bears itself out. In-Q-Tel (IQT) is an example of a strategic VC that has weathered many corrections since its inception 20 years ago and invests through the ups and downs of any business cycle. George Hoyem, Managing Partner at In-Q-Tel and National Venture Capital Association (NVCA) board member commented, “Corporate and strategic investors are no longer ‘VC tourists,’ who exit the VC market in a correction cycle like we see today. Today’s corporate and strategic investors know that some of the best investments and impact is achieved in the jaws of a correction. IQT, like many strategic investors, plans to continue its pace of new investments through this correction.” Over the course of the next several months, the venture ecosystem at large will be presented with new waves of innovation based on emerging paradigms in spaces like healthcare, travel, commerce, fintech, foodtech, and beyond.

The lessons of the 2008 recession have proven highly influential on CVCs founded after that time. That recession technically ended in 2009, long before Toyota AI Ventures (TAIV) was founded in 2017, but the memory of it influenced TAIV’s initial structure and level of independence from its corporate parent. TAIV was launched when the economy was booming, but an economic downturn was expected eventually, and so the fund was built to withstand a recession and avoid the trap that befell many CVCs in 2008. TAIV’s founding managing director Jim Adler explains, “We modeled ourselves after an institutional venture capital fund that prioritizes financial return above strategic return for two reasons. First, the highest strategic value can only be returned by financially strong startups. Second, if strategic return was the priority, our investing capabilities would be vulnerable in an economic downturn, when corporate strategic initiatives are typically the first to go. As a result of our fund structure, we can continue to make investments through difficult economic times like these, when you see unexpected opportunities from the best startup teams.”

In addition to increased investment activity and support of portfolio companies, some CVCs have also begun investing in new areas. Jacqueline LeSage Krause, Managing Director, Munich Re Ventures, points out, “We’re actually a little ahead of where we had anticipated being mid-way through the year, including for new investment themes that we just launched in 2020.” She notes that other activity continues uninterrupted, “Munich Re Ventures is committed to supporting our existing portfolio companies and investing in new companies…and that philosophy hasn’t changed despite these unprecedented times. We’ve seen new highly attractive deals, particularly in Seed and Series A stages, that we’ve added to our portfolio.”

How CVCs are creating strategic optionality during the crisis

A big and unique role CVCs play is to connect their parent companies with startups to drive innovation and strategic value. It is also another way in which CVCs partner with and support the startup community during this time. For example, JetBlue Technology Ventures (JTV) is currently running a six-week “Innovation Sprint” with JetBlue Airways and its ecosystem partners to identify and evaluate over 300 startups providing contactless solutions that reduce person-to-person touchpoints throughout the travel journey. As Bonny Simi, President of JTV, explains, “Startups and new technologies have a huge role to play in helping the travel industry integrate new safety and security measures as it works to welcome back more customers. When corporations like our parent company have to adapt to new environments, CVC firms can be instrumental in helping them do so quickly and successfully. JTV helps to future proof JetBlue Airways and keep the airline as nimble as possible.”

Contactless solutions are just one of the technologies proving to be crucial or resilient during this pandemic – and thus even more attractive for venture capitalists. In the words of Shankar Chandran, Managing Director and Head of Samsung Catalyst Fund, “We’re seeing rapid acceleration of digitization across many areas including data infrastructure, healthcare, commerce, and fin-tech – all driven by consumers changing their habits and preferences. We’ve continued to invest in companies leveraging this trend, believing they have the potential to be leaders among the next generation of successful startups.”

COVID-19 has disrupted people’s daily lives on an unprecedented scale and the end is not yet in sight. Fortunately, CVC has changed in many ways since the financial crisis of 2008. These investors are digging into the challenge by accelerating corporate supporting innovation initiatives, assisting portfolio companies, and looking for solutions that will survive – and thrive – in a post-COVID-19 world. Ultimately, we anticipate the CVC activity of today will not be defined primarily by volume, but rather by the quality of the technologies emerging from this time that CVCs are supporting. The venture ecosystem – and the country – is better for the contributions of corporate venture groups.

—

This article was written in partnership with members of NVCA’s Corporate Venture Group. The mission of NVCA is to advance the global competitiveness of the U.S. venture capital industry. The Corporate Venture Group and its symbiotic relationship with the mission is to advance the competitiveness of the dynamic global innovation ecosystem through collaboration with the venture community. The NVCA Corporate Venture Group (CVG) fulfills the information, education, and networking needs of corporations, enabling them to accelerate the progress of innovation and growth through successful strategic venturing. The CVG is designed to build better communication and practical cooperation across all parties in the venture process, including corporations, venture capitalists, start-up companies, and the research community. For more information about this community, please contact Cassie Ann Kiggen at ckiggen@nvca.org.

If you would like to access more of the data and analysis mentioned in this article, you can refer to the most recent Q2 2020 PitchBook-NVCA Venture Monitor.