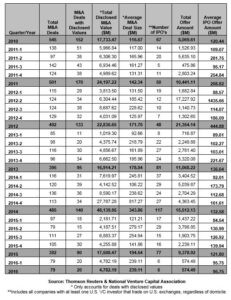

NEW YORK, NY – Six venture-backed initial public offerings (IPOs) raised $574.5 million in the first quarter of 2016, according to the Exit Poll Report by Thomson Reuters and the National Venture Capital Association (NVCA). This marks the slowest quarter for venture-backed IPOs since the third quarter of 2011. By merger and acquisition (M&A), seventy-nine venture-backed M&A deals were reported in the first quarter, 20 of which reported an aggregate deal value of $4.8 billion.

“A strong IPO market requires a stable market for public stocks. Due to a sustained period of turbulence in the public markets at the start of the year combined with non-traditional investors making direct investments into later-stage startups, venture-backed IPO activity in the first quarter was nearly non-existent,” said Bobby Franklin, President and CEO of NVCA. “Despite the successes of a handful of venture-backed biotechnology companies making IPOs, the IPO window for venture-backed companies from other sectors has been completely shut. While this may cause some to panic, venture capital is a long-game business and seasoned venture investors have lived through these slowdowns before. As they wait for the IPO window to open again, venture investors are keeping calm and carrying on, focusing their attention on growing and maintaining their portfolios of the next generation of great American companies.”

IPO Activity Overview

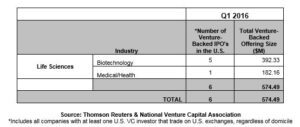

There were six venture-backed IPOs valued at $574.5 million in the first quarter of 2016. By number of deals, quarterly volume fell 65 percent compared to the first quarter of 2015 and registered similar declines by dollars raised. The first quarter of 2016 marks the slowest quarter for venture-backed IPOs since the third quarter of 2011, when five companies raised $475.9 million.

Led by biotechnology companies, all six of this quarter’s offerings were life sciences IPOs. The first quarter of 2016 marks the first time that no venture-backed technology companies listed publicly since the first quarter of 2009, which marked the second consecutive quarter without a U.S. venture-backed listing in any industry.

By location, five of the quarter’s six IPOs were from U.S.-based companies. The largest U.S. offering of the quarter, Cambridge, Massachusetts-based Editas Medicine (EDIT) raised $108.6 million on the NASDAQ stock exchange on February 2nd.

In the largest IPO of the quarter, Beijing, China-based BeiGene Ltd (BGNE), raised $182.2 million and began trading on the NASDAQ stock exchange on February 2nd. At the end of the first quarter, the company traded 22 percent above its $24 offering price.

All six venture-backed companies listed on the NASDAQ stock exchange during the first quarter of 2016.

Five of the six companies brought to market in the first quarter are currently trading at or above their offering price. There are 43 venture-backed companies currently registered publicly for an IPO with the SEC. This figure does not include confidential registrations filed under the JOBS Act, where many observers believe the majority of venture-backed companies now file.

Mergers and Acquisitions Overview

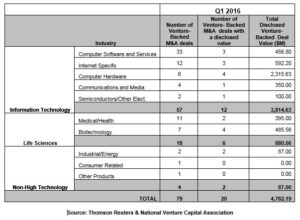

As of March 31st, 79 venture-backed M&A deals were reported for the first quarter of 2016, 20 of which had an aggregate deal value of $4.8 billion, a 19 percent decline compared to the overall number of deals reported during the first quarter of 2015, but double the disclosed M&A value registered a year ago.

The information technology sector led the venture-backed M&A landscape with 57 of the 79 deals of the quarter and had a disclosed total dollar value of $3.8 billion. Within this sector, computer software and services and internet specific deals accounted for the bulk of the targets with 33 and 12 transactions, respectively.

The largest venture-backed M&A transaction during the first quarter of 2016 was Cisco System’s $1.4 billion acquisition of Mountain View, California-based Jasper Technologies, followed by NetApp Inc’s $870.0 million purchase of Solidfire, Inc, a Boulder, Colorado-based provider of data storage systems. France’s Thales SA acquired San-Jose, California-based Vormetric Inc for $400 million, which ranked as the third largest venture-backed M&A deal during the quarter.