NVCA Provides Resources and Insights for New VCs

Last week, NVCA held a digital class on Successful Fundraiser’s Philosophy: How Micro VCs Get Off the Ground & Succeed. With micro VC funds playing an important role in the startup lifecycle—micro VC funds closing in 2016 finished with $1.5 billion in commitments, according to PitchBook—NVCA and our members are an important resource for new fund managers who are getting off the ground and learning to navigate the fundraising process. The formation of new venture capital funds is critical to the future of innovation, and NVCA was pleased to be able to provide the ecosystem with tools and insights to help expand the VC community.

We began the webinar with an insider’s perspective from Cindy Padnos of Illuminate Ventures on how micro VC is evolving and what were some of the lessons that she learned from the process of raising her first institutional fund. Padnos described what it was like for her to launch a new VC firm, from Illuminate’s proof of concept fund, to how she brought in original investors and how the success of that fund helped her close Illuminate’s Fund 1 in 2013, from which Illuminate has made 15 investments and so far has had 3 M&A exits.

Padnos discussed how to differentiate yourself as a micro VC, explaining that simply saying you’re “super supportive of entrepreneurs” is not enough, and that you have to go beyond that to differentiate yourself to LPs. At the same time, she cautioned against becoming so narrowly differentiated that institutional investors are concerned about your potential longevity.

“I think if you are going to be a micro VC you have to invest in what you know and where you can add value beyond your dollars, because the dollars are small. If that means that is a vertical focus for you, then you shouldn’t be influenced by what one LP might think,” said Padnos. “We are vertical to the extent that we are enterprise, technology only, but I would say focus on what you know, what you know you can have a positive impact, where you know you can get access to great deal flow—and you’ll find the right LPs that care about that.”

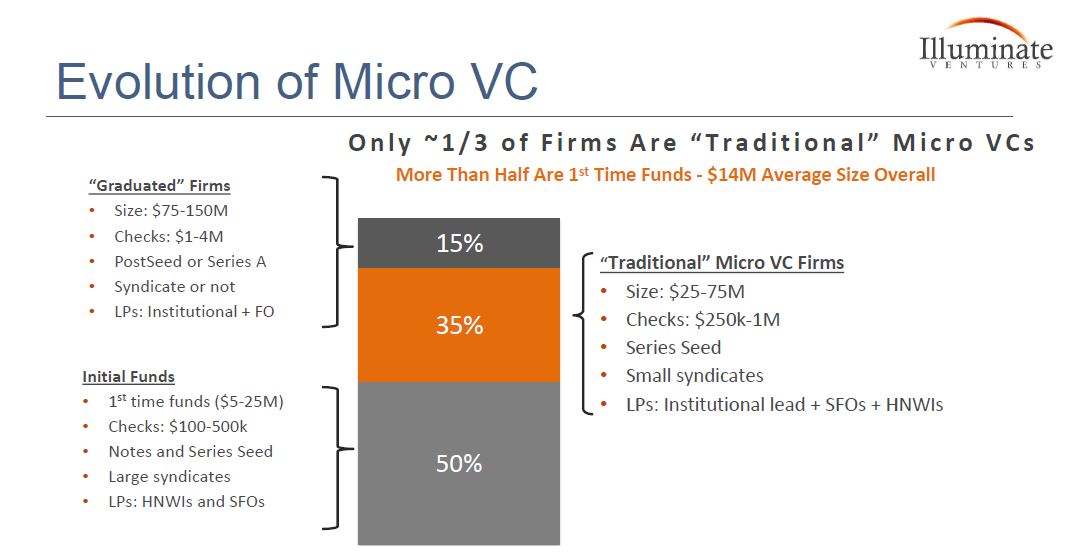

In addition, Padnos talked about how the micro VC space has evolved since she founded Illuminate Ventures in 2009, when there were less than 30 micro VCs funds. Today, there are closer to 500 micro VCs. This transition has led to a change in how micro VCs operate and invest, Padnos says.

“Micro VCs have become known as being the first institutional investor for startups—but frequently even today there are a large number of investors (8-10) in a single financing,” Padnos explained. “We continue to prefer smaller syndicates. When Illuminate started a typical round was around $1-2 million, now they have evolved to $2-4 million, but the pre money valuations have not escalated at nearly the pace of later stage financing rounds.”

After Padnos’s insightful presentation, Hunter Somerville, partner at Greenspring Associates, took the (digital) stage to talk about the first 100 days of raising your fund, and how to find, communicate with, and convert LPs. About a year and a half ago, Greenspring launched a fund-of-funds focused exclusively on the micro VC category, which Somerville helps run.

Somerville emphasized that the first 100 days are critical to building momentum on fundraising while finding the best matches in the limited partner community. Key to that communication with LPs is knowing how to share your track record.

“When communicating the prior role of the fund manager, their role should feed directly into the strategy of the go-forward fund from a domain expertise standpoint as well as how it gives rise to proprietary sourcing channels,” said Somerville. “Another micro VC category we’re seeing are junior investment professional who are spinning out of an established brand to do their own thing. Their company-by-company prior track record should be displayed with true transparency around the role they served in each investment. If the individual was just involved on the sourcing side, which is often the case, you shouldn’t overplay the hand and act like the only deal lead. Let your references do the talking for you and explain exactly what role you played.”

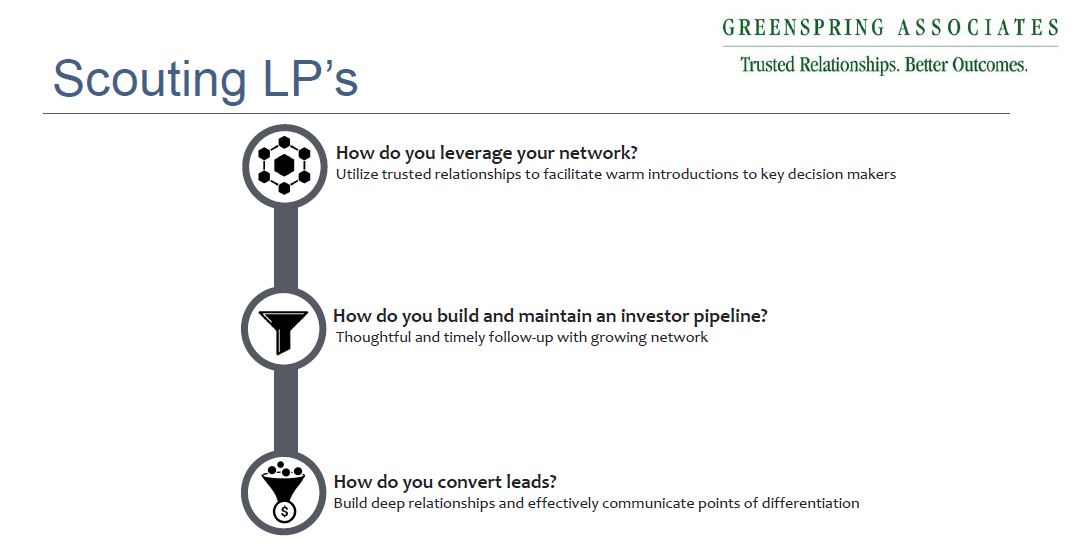

But for a new manager raising their first fund, their focus should not solely be on communicating with LPs. They also need to find the right LPs to connect with, which is why scouting LPs is also crucial for emerging managers. Somerville offered advice for new VCs on what’s important when trying to find good LPs.

“I don’t subscribe to the sourcing approach of going to conferences and meeting people that way,” Somerville said. “I think the best way to fundraise for an early raise is conscientiously mapping out your network, looking for potential supporters that are close connections, developing early a high net worth support and using that to drive toward a first close.”

As important as connecting with LPs are for an emerging manager, there are also other, alternative fundraising platforms that can help VCs raise their first fund. Lee Jacobs, partner at AngelList, dived into the details on how emerging managers can leverage alternative platforms for raising their first fund.

“We found that a lot of the people we work at AngelList are executives at top venture-backed businesses that have done angel investing,” said Jacobs. “We are working on new ways to announce returns from the early syndicate leads and the people who are doing really well will be able to garner backing. But we understand that there are Emerging Managers who may not have followers. We encourage these folks to send AngelList your track record. If it’s something we know that our capital sources will be interested in, we will help Emerging Managers facilitate that transaction.”

“Over time, as you build a track record with institutional investors, you’ll have a better following,” Jacobs concluded.

We were pleased that we had a very large, engaged audience for our first digital class for emerging managers and micro VCs, and many thanks to our speakers for providing their insights to the next generation of VCs.

For NVCA members who were unable to attend, login to the member portal and then click here to access the recording of the webinar.