Ecosystem Spotlight: A Bright Future for Emerging Wisconsin

When Greg Robinson decided he wanted to create a new venture capital firm, he wanted to build it in a place with an abundance of momentum and entrepreneurship, and a great interest in tech and disruption. But the place he decided to build his new venture firm—the area with those qualities he deemed key to success—was not sunny Silicon Valley, bustling New York or dynamic Boston. Instead, Robinson launched 4490 Ventures in Madison, Wisconsin.

Longtime Wisconsin venture capitalist John Neis of Madison-based Venture Investors, himself a Wisconsin native, certainly understands the feeling about Wisconsin’s startup ecosystem that drew Robinson to the cheese state. After graduating from the University of Wisconsin, Madison, Neis felt that there was tremendous opportunity for entrepreneurship in his home state, especially with a top research university like the University of Wisconsin.

“There have been ebbs and flows in the venture activity in Wisconsin over the years. Most of our co-investors from the early years no longer exist or changed focus,” Neis said. “But we’ve seen a surge of funds and startup activity in the last few years. There is a bunch of early-stage VC firms along with a healthy Angel activity that is creating a lot of excitement.”

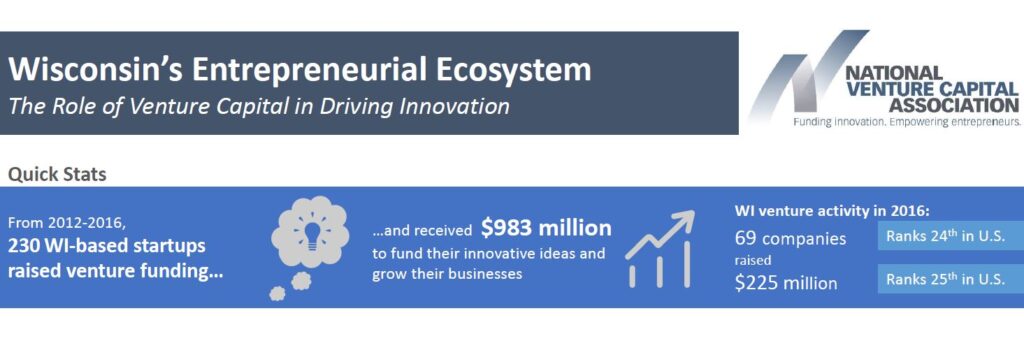

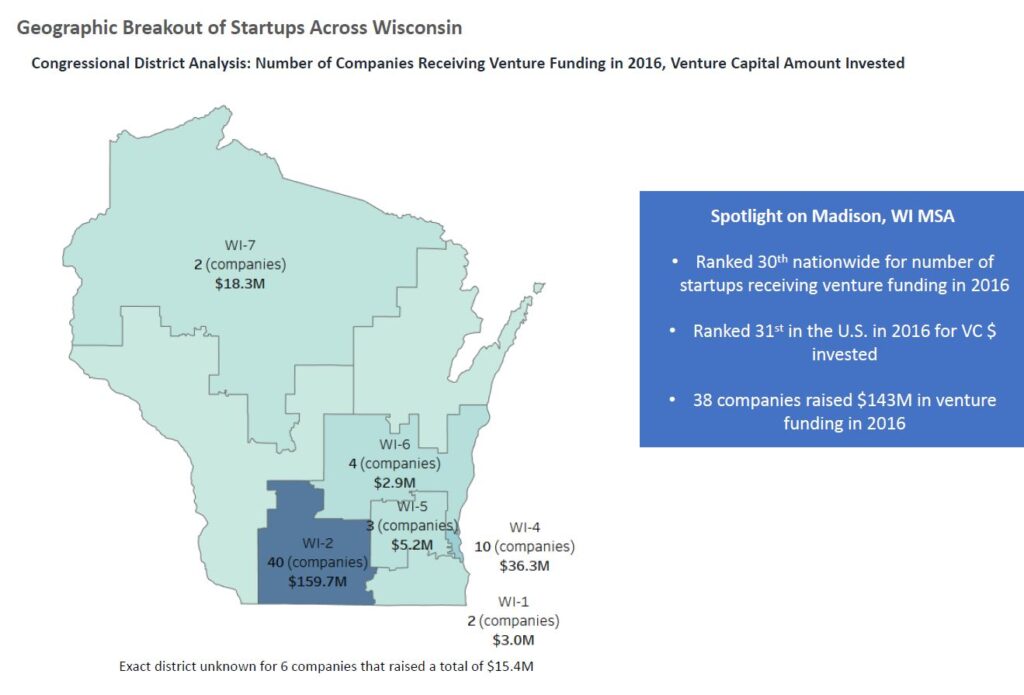

The numbers back up Neis’s impressions of the recent success of the Wisconsin ecosystem. Over the last five years, 230 Wisconsin-based startups have received $983 million in venture capital funding, according to the PitchBook-NVCA Venture Monitor. The last three years have been especially strong for Wisconsin, as venture investment hit $225 million or more each year, with 2014 seeing a banner $254 million.

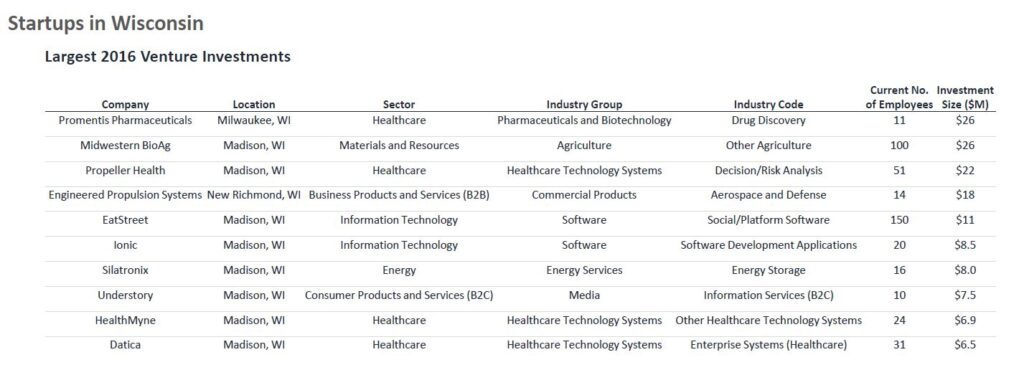

A large portion of this venture activity comes from health care startups, in particular health care IT. Over the last five years, healthcare startups in Wisconsin have received almost 53 percent of the state’s venture funding. In 2016, Promentis Pharmaceuticals and Propeller Health received two of the largest venture investments in the state.

Wisconsin also has a strong presence of IT and B2B startups. Engineered Propulsion Systems, a B2B startup, and IT startups EatStreet and Ionic received some of the largest venture investments in Wisconsin in 2016.

But what are the reasons for Wisconsin’s progress? Robinson thinks he understands the formula for Wisconsin’s burgeoning success—in fact, it is what drew him to the state in the first place.

“We have the raw materials to do disruptive things, with the research institutions, the number of engineers, patents, and really smart people,” Robinson says. “There’s an incredible amount of talent, with young college grads seeing the startup economy in Wisconsin as a viable career path. Entrepreneurs can be anywhere, and Wisconsin is in a really good position to support our entrepreneurs as they build great companies.”

Neis agrees with that assessment.

“Our competitive advantage has been fueled by early research, most of which has been carried out by our great research Universities, our low cost of business, and the strength of our talent pool,” said Neis. “There’s a combination of collaboration, work ethic, and humility that enables people to work together here really well.”

“The future looks good, as we get more investors becoming active, especially in Madison. And Milwaukee is also really focused on increasing its entrepreneurship.”

While there are plenty of positive signs in Wisconsin’s entrepreneurial ecosystem, there are also many challenges. Both Neis and Robinson agree that access to capital is still lacking even with the growth of Wisconsin’s ecosystem. Early-stage investments can be made locally from venture firms in Wisconsin and the Midwest, but capital for later-stage rounds is harder to come by. Life science startups in particular often depend on later rounds and patient capital in order to be successful.

That is why building relationships with venture capital on the coasts and attracting more capital from around the country is going to be crucial for the startup ecosystem in Wisconsin to continue to grow and develop.

To help face these challenges, Venture Investors and 4490 Ventures re-launched the Wisconsin Venture Capital Association (WVCA), whose mission is to encourage investor participation and collaboration in Wisconsin’s entrepreneurial ecosystem. NVCA supported its relaunch by co-hosting “The Future of Innovation in Wisconsin and the U.S.” where Bobby Franklin, NVCA President and CEO, discussed the important ingredients for regional ecosystems to be healthy and successful, including how collaboration and the right policies can support regional ecosystems like Wisconsin.

The new WVCA will focus on enhancing VC networking and collaboration, advocating to policymakers on behalf of Wisconsin’s entrepreneurial ecosystem, highlighting the role models and success stories in Wisconsin, and building investor interest in the VC sector.

Having the WVCA advocating on behalf of venture capital and the startups they invest in will help Wisconsin’s entrepreneurial ecosystem address its challenges and continue to develop and accelerate. While there is still plenty of crucial work to be done, the future looks bright for Wisconsin’s entrepreneurial ecosystem.