VentureForward Blog Series: Canaan Forward – Diversity as an Asset

Note from NVCA: As part of NVCA’s VentureForward initiative, we launched this blog series in November 2017 for industry leaders to share their perspectives on why diversity and inclusion (D&I) are important for the future of VC, their firm’s activities and approach to D&I, and guidance for how we—as an industry—can drive meaningful change.

Stay up to date on the latest VentureForward news, resources, and releases here. Contact ventureforward@nvca.org to learn more and get involved.

Maha Ibrahim, General Partner at Canaan Partners, continues the series with her post below:

Canaan Forward: Diversity as an Asset

I wish I could say our firm intentionally set out to break ground for women in venture capital. That was not the case. We are a surprising firm to have ended up on the leading edge of diversity in venture, having originally spun out from GE in the late 1980s. There was no explicit goal set to hire women, no quota aspiration. Despite that, three of our general partners are women, and 40% of our investing team is female. Each of us were hired not for the sake of gender diversity but for our track records – both in and out of venture – and to strategically expand the talent and experience of the fund’s leadership. I joined Canaan in 2000 as a Principal and rose up the ranks to become a General Partner 5 years later. Wende Hutton joined Canaan in 2005 after a tenure as General Partner at Mayfield and Nina Kjellson joined Canaan in 2016, also having been a General Partner at Interwest. Each of our paths to Canaan were different, but none of us would have come here, stayed here or thrived here if not for a few fundamentals.

Culture: Be It to Build It

In Silicon Valley, the importance of culture is often buzzed about, but hard to pin down. It takes work – work that belongs to everyone and no one – to build the right culture for a particular organization. In my experience, culture is a critically important variable in the success of women at an organization. What’s the decision-making structure? Is it limited to an individual or small investment committee? What kind of transparency is built into leadership decision-making? And the compensation structure? As we look around today and see the encouraging trend of venture capital firms beginning to add women to their ranks, the answers to these questions will have a fundamental impact on those women’s success. Taking a transparent, open and flat structural approach to these core pillars of a venture firm has had a huge impact at Canaan. Our investment decisions are made by the full partnership – giving every GP one vote. We have a compensation structure that is performance based and in which tenure is not a factor. That means newer additions to the team have as much skin in the game – and opportunity – as anyone else.

Our firm also takes mentorship of our young investors very seriously. Success in this industry hinges on one’s exposure to deals, and to investors who have the benefit of experience. We are rigorous in mentoring our own. I’m a great example of that, having started at Canaan as a Principal, but we have a number of others who started as analyst or even interns who are now Partners and General Partners.

Another critical piece? We have a no assholes policy. It may sound trite, but it’s a well-understood truth that asshole behavior is not tolerated at Canaan. Sometimes that’s meant hard decisions and departures. At other times, we’ve been able to work through those disruptive attitudes with a direct and transparent approach to fixing the problem. Above all, it puts respect for one’s peers and entrepreneurs first because absent that, we can’t be successful.

Mirroring the Entrepreneurial Pool

Our fundamental belief is that venture capital firms must reflect the entrepreneur base. My fellow female GPs and I have each been the only woman at the table at different times in our careers. And we can attest that there is a big difference between hiring one woman and hiring two. With two women at the table, they are pattern-matched to one another – not to anyone’s wife or sister or daughter. There’s an even bigger impact going from two women to three, which, begins to look like a post-gender world. In that world, the topic of diversity and inclusion is not taboo. It is front and center. In this world, we’ve been able to continue hiring women, who can see their aspirations reflected in senior women at the firm. We’ve also built a team that is 47% immigrant or first-generation, again seeking to mirror the entrepreneurial base.

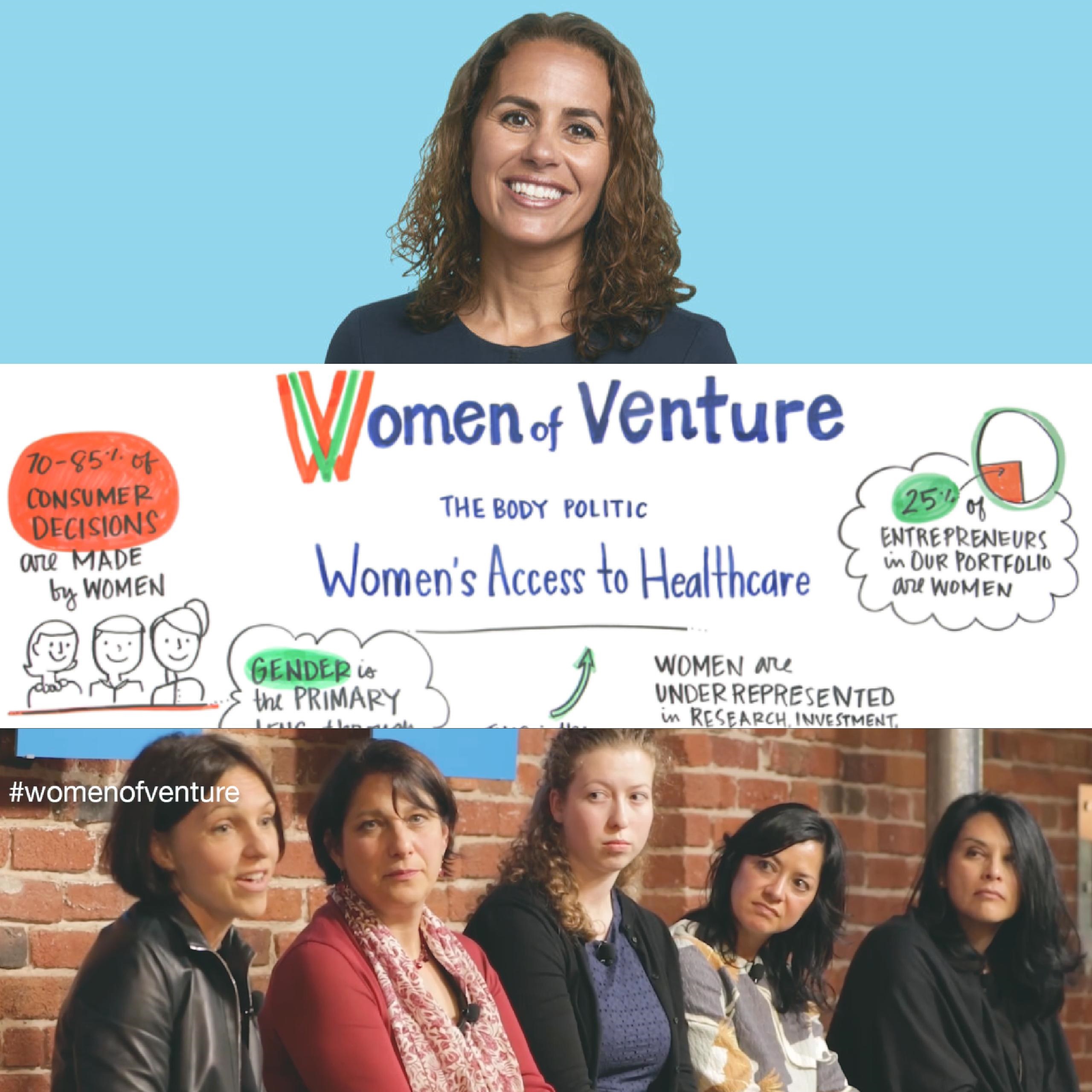

Women of Venture

We are committed to fostering conversation and community among entrepreneurs, venture capitalists and leaders who are passionate about women’s issues. Last year we launched a Women of Venture program as an unabashed platform to advocate for women. Through events, thought leadership, and mentorship, we aim to be a resource for women in the venture and entrepreneurial communities – and for those considering careers in venture capital.

So, is there a master recipe for building a diverse team and giving them the tools to succeed? I wish it were that simple. For Canaan, an early part of our success must be credited to the character and commitment of the men who were early leaders at our firm – including our co-founder Eric Young. They were very clear about the kind of culture they wanted to cultivate – long before we had any women as General Partners. And they were rigorous in making it happen.

That’s an important facet of today’s debate because so many firms are still male-only or have limited female leadership. That doesn’t make it impossible – Canaan is proof of that – but a focus on diversity and inclusion must be authentic, take a 360 view, and have shared ownership.

Read the other posts from this series:

Greg Sands – Focus on Progress, Not Perfection

Lisa Lambert – Diversity & Inclusion is a Growth Story