VC Research Spotlight: How Do Venture Capitalists Make Decisions?

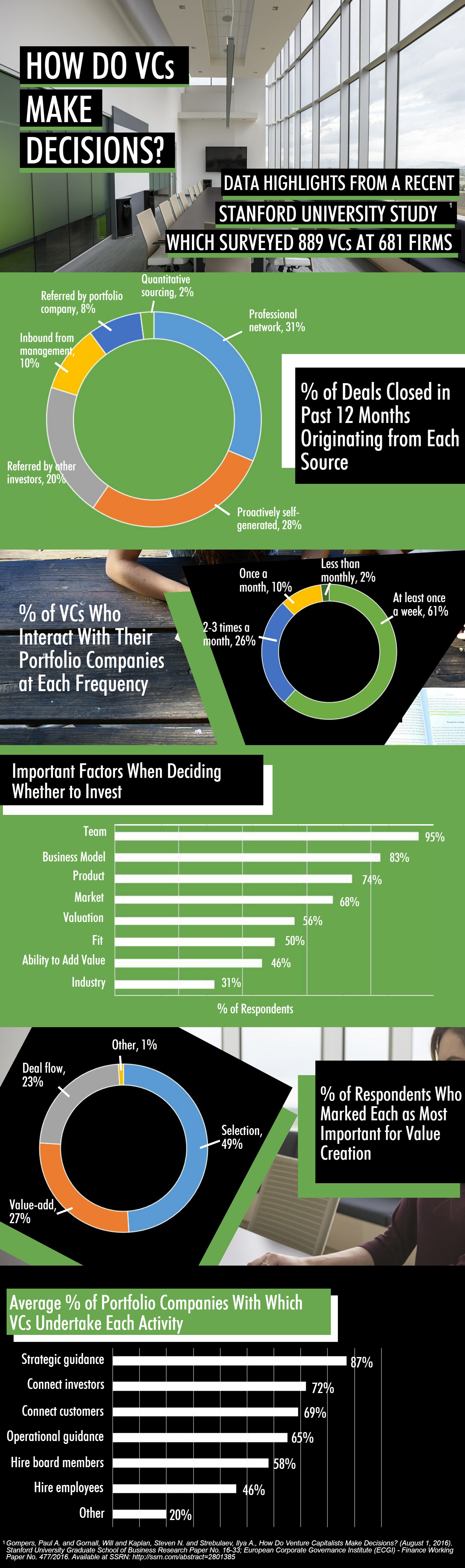

What’s the secret sauce for venture capital investing? Unfortunately, I don’t have the answer, but it’s not surprising that the topic has piqued the interest of a number of academics. A recently-released Stanford University Graduate School of Business paper – “How Do Venture Capitalists Make Decisions?” – assesses the VC decision making process to better understand what venture capitalists (VCs) do and why they have been successful. The study examines eight areas of VC decision making: deal sourcing; investment decisions; valuation; deal structure; post-investment value-added; exits; internal organization of firms; and relationships with limited partners.

About 900 institutional VCs at 681 firms were surveyed (including many NVCA members), and the findings shed light on the complex world of venture investors. At a high-level, two things stand out: 1) it is no understatement that VCs make lots of critical decisions across multiple levels of management – investments, portfolio companies, firm-level, and LPs; and 2) there isn’t a “one-size-fits-all” approach – VC practices vary across industry, stage, geography, and past success.

Some highlights of the paper’s findings:

Download the infographic here.

Ilya Strebulaev, one of the co-authors and a professor at the Graduate School of Business at Stanford University, will discuss the findings from the paper on an NVCA webinar on September 23rd. There will be time for Q&A, but please feel free to send questions ahead of time to research@nvca.org. Register here.