Ecosystem Spotlight: Pure Michigan, Pure Entrepreneurial Growth

A San Francisco native with an MBA from Wharton and experience working at two successful medical device startups in the Bay area, Jan Garfinkle was a trailing spouse when she moved to Michigan over 20 years ago. At the time, there were less than ten venture capital firms in existence in Michigan. Today there are 25, including Arboretum Ventures, which Jan founded in 2002 and remains a Managing Director today.

You don’t meet many San Francisco natives who move to the Midwest to chase a career in venture capital. In fact, one could make the case that that would be the least effective way to break into an industry that is predominantly centralized around a single road in Palo Alto, CA. But for Jan it worked, and in many respects her story is the story of Michigan’s growing entrepreneurial ecosystem.

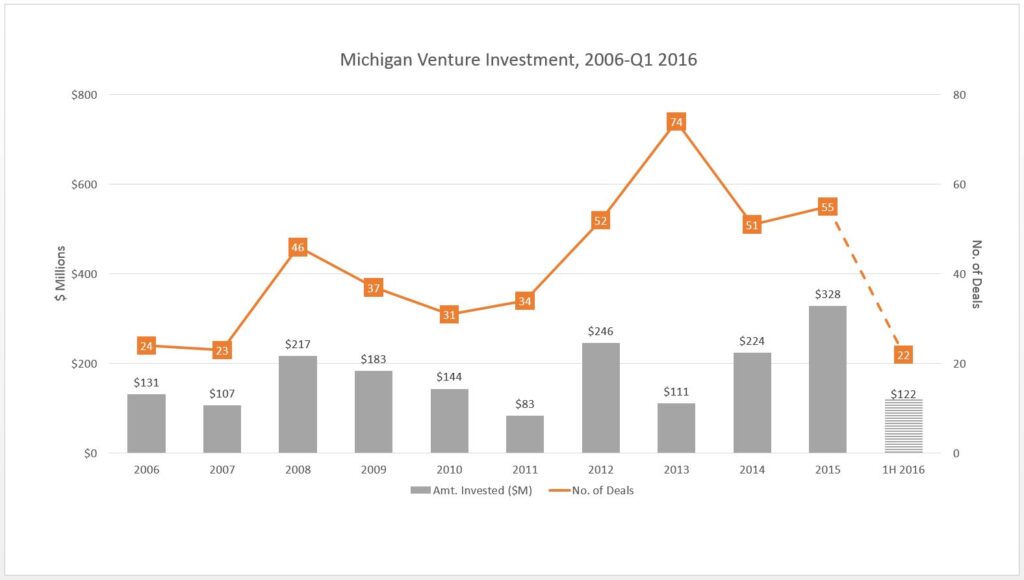

According to our friends over at the Michigan Venture Capital Association (MVCA), in the last 15 years, the number of venture capital firms in Michigan has grown by 257% and the total capital under management has grown by 325%. As detailed in their annual research report (which, by the way, you should do yourself the favor and bookmark now!) the byproduct of the growth of Michigan’s venture capital industry has resulted in a 145% increase in the total number of venture investments into Michigan startups.

This impressive growth isn’t surprising to Jan, a member of the NVCA Board of Directors, who described the Michigan entrepreneurial ecosystem as “nascent” when she first moved to the state 20 years ago but is now “quite robust” and growing. “There have been many large exits over the past decade which have created some great management teams that want to continue to develop and grow companies [in Michigan],” she said.

Citing Jeff Williams, CEO of Ann Arbor-based molecular diagnostic testing company NeuMoDx, who was previously President and CEO of three other Michigan-based life sciences companies, Jan credited the development of this homegrown talent as a key ingredient that is powering this virtuous cycle of success, where entrepreneurial leaders in Michigan start a company, sell or take it public, and then start the process anew once more.

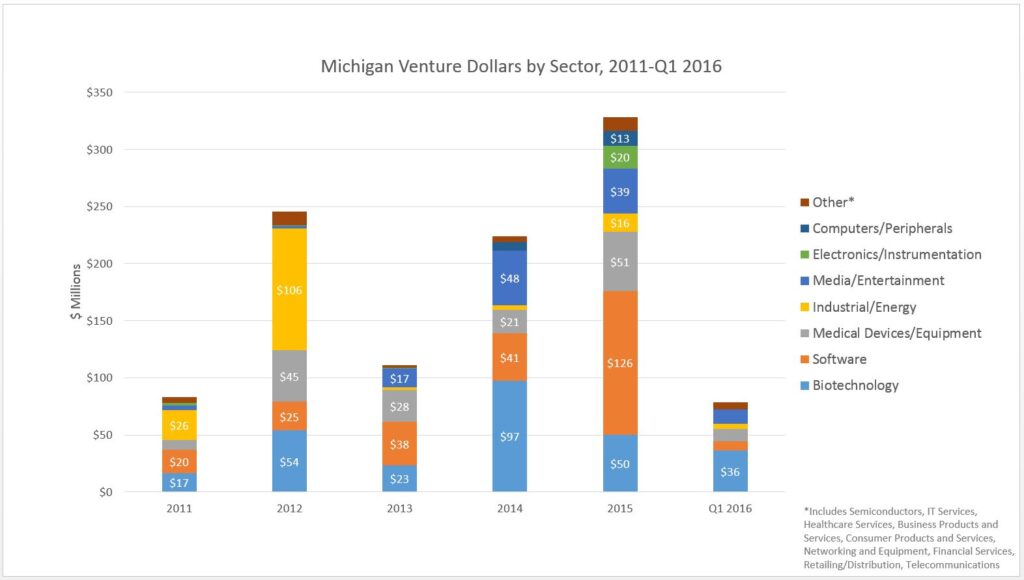

As Jan explains, Jeff and his team are terrific at developing companies that are revolutionizing the diagnostic industry, so it only make sense that after successfully starting one, why not start another, and another. This phenomenon is not just isolated to Jeff and his peers in the diagnostic space, according to Jan. “There are many examples of people like Jeff in the healthcare, software, cybersecurity and advanced manufacturing sectors.”

Due to the efforts of leaders like Jeff who are building great companies in Michigan, total venture investment in the state reached a 10-year high in 2015, when venture investors deployed $328 million to startups in the state. “Success breeds success,” said Jan, “and we are starting to see more companies successfully raise new rounds.”

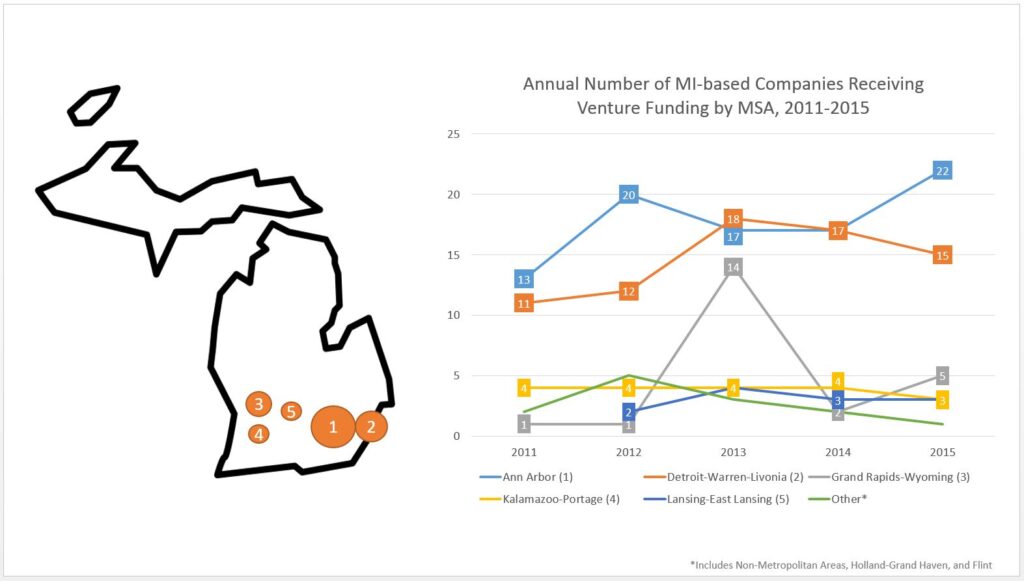

With Detroit being Michigan’s largest city, you would assume that much of this recent success would be centralized in the Motor City. Not the case. The true epicenter of Michigan’s entrepreneurial ecosystem is Ann Arbor, where the largest number of Michigan-based startups call home.

So what is it exactly about Ann Arbor, Michigan’s sixth largest city by population, that breeds such a dynamic entrepreneurial spirt? For starters, it’s just a great place to live with a great sense of community, confirmed Jan, herself an Ann Arbor resident. Other than the great lifestyle benefits that act as a natural magnet, Ann Arbor has done a good job supporting the infrastructure to create a robust ecosystem built around the University of Michigan, two very successful hospitals, a strong support system of angel investors and, of course, great venture firms.

Indeed, it’s the Michigan-based venture firms like Arboretum and others that have played a central role in growing Michigan’s entrepreneurial ecosystem. According to Jan, Michigan startups typically have a Michigan-based venture fund as the lead investor, but will successfully recruit out of state funds to join their syndicate. “We’ve never had another fund refuse to join our syndicate because the company is located in Michigan or the Midwest,” said Jan. “In fact, it’s a positive to be located in the Midwest,” she added, citing a study which found that it costs 30% less to develop a company in the Midwest compared to San Jose, CA. “This lower cost means higher returns for the venture funds, which is key to their long-term success.”

These low costs have no doubt contributed to Michigan’s rise as a top destination for venture capital investment in the U.S., experiencing the 11th highest growth rate nationwide in the number of companies receiving venture funding between 2010 and 2015. If Jan and others continue to find success investing in innovative startups in Ann Arbor and elsewhere in the state, there’s no doubt Michigan will continue to rise to the top. Ultimately, this will attract more out of state investment and, perhaps, motivate some firms to open satellite offices in Ann Arbor. “Four of our six largest exits were within one mile of our office,” said Jan. “It’s hard to argue with these numbers, and we believe being in Ann Arbor is our biggest competitive advantage.”