Why Immigrant Entrepreneurs are Crucial for America’s Future

On Monday, the Department of Homeland Security was scheduled to begin receiving applications from foreign-born startup founders under the International Entrepreneur Rule. Unfortunately, the Trump Administration delayed the rule with an eye on eventually rescinding it, shutting down a commonsense policy tool that would have kept job-creators in the U.S. to build their companies here and hire American workers.

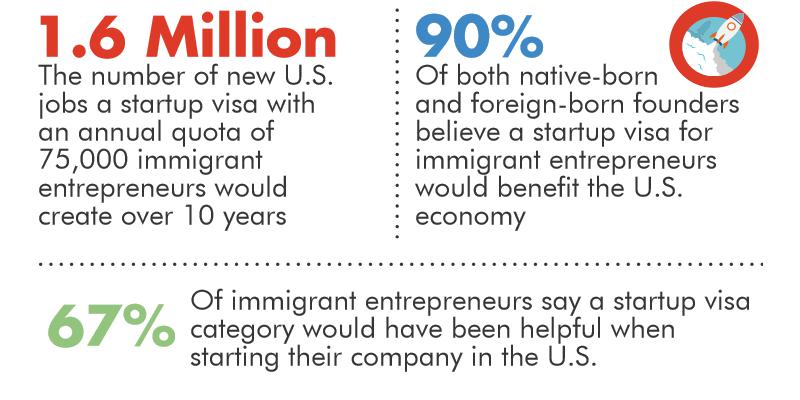

As a quick refresher, the International Entrepreneur Rule was put in place during the final days of the Obama Administration and would have created a regulatory structure similar to a Startup Visa, which NVCA has supported for over a decade. While the Startup Visa has been caught up in the broader immigration reform efforts that have stalled in Congress, the International Entrepreneur Rule had the potential to accomplish many of the same outcomes.

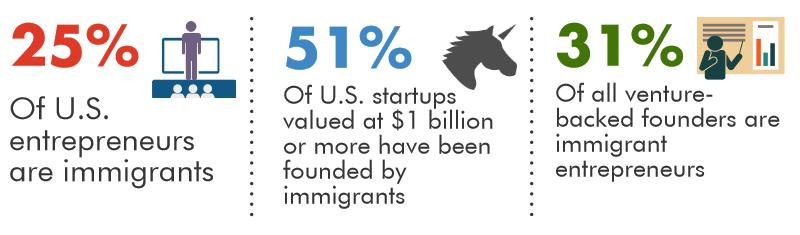

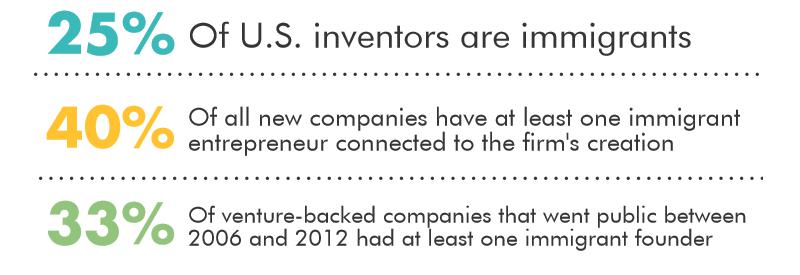

One of the key factors of America’s incredibly successful entrepreneurial ecosystem is the invaluable role immigrant entrepreneurs have had on new company creation and the corresponding economic activity generated by them.

The ingenuity and creativity of immigrant entrepreneurs who choose to build and grow their businesses in the United States is invaluable to the American economy. Venture-backed companies with at least one immigrant founder include American icons like eBay, Facebook, Google, Intel, LinkedIn, Zipcar and Tesla Motors.

The ingenuity and creativity of immigrant entrepreneurs who choose to build and grow their businesses in the United States is invaluable to the American economy. Venture-backed companies with at least one immigrant founder include American icons like eBay, Facebook, Google, Intel, LinkedIn, Zipcar and Tesla Motors.

To explore how crucial immigrant entrepreneurs have been to the U.S. startup ecosystem, how important they are to the future of the U.S. economy, and how impactful policies to attract more immigrant founders (like the International Entrepreneur Rule) could be, we reached out to some of our members who invest in U.S. startups that are innovating and creating American jobs.

Immigrants are a key part of American entrepreneurship

Bill Draper, an early pioneer of the venture capital industry, has a unique perspective on the impact immigrants have had on the startup industry and Silicon Valley:

“Silicon Valley would not be half as successful without the immigrants that have founded and been involved in so many startups since the beginning of the venture capital industry,” said Draper. “Immigrants are such a key part of the entrepreneurial spirit in America. Immigration has been at the root of this country since the beginning, and we need to hold on to it and encourage it.”

“Immigrants are fueling the next generation of high growth companies,” says Maha Ibrahim of Canaan Partners. “Over 50% of the current crop of high growth companies were founded by an immigrant or by a first generation American. Those immigrant founded companies are creating thousands of jobs, not just in Silicon Valley, but across the entire United States.”

“The majority of the investments I’ve made have at least one founder from another country, and those companies have created over 10,000 American jobs, and I’m just one VC investor working at one firm,” said Neeraj Agrawal of Battery Ventures. “When you look at the whole industry, there are so many good jobs being created and so much economic activity that immigrant entrepreneurs contribute to. That activity is critical to the U.S. economy and our competitive advantage as a nation.”

America doesn’t own innovation and VC anymore

As important as venture capital and startups have been to the American economy over the past five decades, VC and startups are no longer a uniquely American institution. The rest of the world is catching up to the U.S. by creating successful innovation ecosystems of their own, which means that the U.S. is not the only place for founders to grow successful companies anymore.

“Unlike a few years ago when 80% of the world’s venture capital activity was in the U.S., it’s dropped to 54%,” says Jeff Clavier of SoftTech VC. “Much of that decline is because China and Europe are now credible alternatives. There is a competitive market out there, where, arguably, you could build a startup in Paris, Berlin, London or Beijing with the same support and success from the ecosystem there as you would in Silicon Valley or other parts of the U.S. We’re making it harder on ourselves by having a limited immigration policy where we don’t welcome entrepreneurs with open arms, the way other countries are doing, countries that have visas for entrepreneurs.”

Rich Wong of Accel Partners echoes Clavier’s sentiment: “There is intense competition across the world to try to get startups. Whether it’s Canada, Australia, or China, there are incentives being created for founders from those countries to stay where they are instead of coming here. R&D credits, tax credits, funding (for) engineering costs, and other incentives are being used to either keep founders there, or at least to grow their employment base in those other countries.”

With many other entrepreneurial ecosystems are developing all over the world, the competition to attract talent has become much fiercer. Somesh Dash of IVP notes that, “the entrepreneurial ecosystem in many immigrants’ home countries—like China, India, Taiwan, and Brazil—are more robust than they were ten, fifteen years ago. There is capital, resources, and talent that are available in their home country, and those countries are offering the kitchen sink to welcome entrepreneurs back there.” The reality is the U.S. is no longer the only hub for innovation and venture capital.

We want the best-and-brightest building new companies in the U.S.

In order to stay globally competitive in the field of innovation, we want the best-and-brightest building new companies in the U.S., rather than in other countries.

Andy Schwab of 5AM Ventures believes that if we can’t find ways to make it easy for the best and the brightest to stay here in the U.S., then they’ll have no choice but to return to their home country, and build their companies there:

“If we can’t give potential entrepreneurs long term clarity on their immigration status, then they’ll decide to go back to Shanghai or Australia or wherever they’re from and start their company there. Many startup founders would like to start a company in the U.S.—but because they couldn’t figure out their immigration status in America and they were able to get capital back in their home country, they decide to go back to where they were from and start a company there instead of in the U.S.”

Agrawal agrees, and elaborates further on what could happen to our pipeline of entrepreneurs if we don’t find ways to attract talent:

“Really bright, STEM oriented kids are now asking, ‘should I go to the UK?’ ‘should I go to Australia?’ or what’s becoming more common, ‘should I go to Canada?’ I think we could see a lot of market loss to Canadian tech markets. Talented founders will instead go to Vancouver or other cities in Canada where they can get 90% of an American quality of life and not have to deal with the uncertainty. If they’re scared to make that bet on the U.S., then we’ll lose a huge part of our pipeline for entrepreneurs.”

“The greatest defense we have against the rise of other economies like China and other nations is our entrepreneurial ecosystem,” said Saar Gur of CRV. “So any effort to bring great entrepreneurs here to build their business in the U.S. instead of in some other country is very important and will help our nation’s economy. We need to make it easier for really talented folks to be here and help our country, especially relative to the alternative of having those people be in other countries and adding to those countries’ economies.”

We need policies that will help keep job creators in America

With so many other countries around the world becoming attractive locations for entrepreneurs to move to and build companies, the U.S. needs policies that attract job-creating entrepreneurs and allow them to stay here to build their companies that create new jobs for Americans. Reforming the H1-B system and allowing foreign-born STEM field graduates from U.S. universities to stay in the country would be positive steps in the right direction. And, of course, a Startup Visa for immigrant entrepreneurs, with the International Entrepreneur Rule being the closest America has gotten to enacting one, would be incredibly helpful for attracting and keeping more job-creating entrepreneurs in the U.S.

This is why the move by the Trump Administration to delay and ultimately rescind the rule is such an unfortunate policy move, as the rule had the potential to keep job creators in the U.S. to build their companies here. VCs who are investing in job-creating startups agree:

“I think something like the International Entrepreneur Rule could be incredibly helpful,” said Schwab. “There are all of these founders who are coming out of the best universities in the U.S. with great ideas who could be really high-quality entrepreneurs in the U.S. If we were to have a system in place to enable them to stay here that could be incredibly valuable for our economy.”

Put frankly by Ibrahim, “if you care about jobs in this country, then you care about whether or not the International Entrepreneur Rule is enacted.”

At its core, the International Entrepreneurship Rule is about job creation and boosting the economy, as Wong explains:

“The International Entrepreneur Rule actually has little to do with immigration in the traditional sense. This is about job creators, and whether we want job creators to be here, or somewhere else. I would really call this the International Job-Creator Rule. The question is whether we want job creators here in the U.S., or in Beijing, and the rule would help keep them here, build their companies here, and create jobs here. Why wouldn’t we want job creators to be based here in the U.S.?”

Wong goes on to say that, “it’s not a secret that if you can attract the next generation of startups and great companies to your country, there are many positive economic effects that will follow.”

Clavier warns that investors may look outside of the U.S. if it becomes increasingly difficult for founders to remain in the U.S., stating, “If we don’t have the International Entrepreneur Rule and they clamp down on other forms of immigration, we will absolutely see VCs reducing their investments in the U.S. VCs will have to find alternatives. If that were to happen, investors would set up something in Canada so that those immigrant founders could set up companies in Canada, instead of America, and we’d spend more money in Canada, and U.S. VCs might start looking at investing in Europe.”

“The challenge for the U.S. is with the next generation of startups that will become the next Facebook, Google, or Amazon (these very valuable companies employing hundreds of thousands of people) and whether these companies be here, or overseas, whether in other startup economies such as Stockholm, Vancouver, or Beijing,” said Wong. “We would much rather have the next generation of great companies based here in the United States.”