NVCA Member Spotlight: Ironspring Ventures

Welcome to our Member Spotlight series where we give a profile overview of our many diverse members. For this deep dive, we spoke to Ty Findley, Managing Partner at Ironspring Ventures, to learn more about his firm.

Tell us about your firm. What makes it different?

Myself and my partners, Adam Bridgman and Peter J. Holt, came together because we saw a massively underserved opportunity to support ‘digital industrial’ founders innovating within legacy industrial industries that shape the way our world designs, builds, distributes and operates daily. Whether in construction, manufacturing, transportation, or energy & resources, a majority of the US GDP is made up by these critical industries (and associated skilled laborers/heroes) that we cannot afford to leave behind in the digital wave that is underway. We are different because of that sector-focus and subsequent ability to leverage our global industrial network to drive value back to our portfolio companies that is highly curated to industrial markets.

Myself and my partners, Adam Bridgman and Peter J. Holt, came together because we saw a massively underserved opportunity to support ‘digital industrial’ founders innovating within legacy industrial industries that shape the way our world designs, builds, distributes and operates daily. Whether in construction, manufacturing, transportation, or energy & resources, a majority of the US GDP is made up by these critical industries (and associated skilled laborers/heroes) that we cannot afford to leave behind in the digital wave that is underway. We are different because of that sector-focus and subsequent ability to leverage our global industrial network to drive value back to our portfolio companies that is highly curated to industrial markets.

We’re able to do this because all of us come from backgrounds both operating and investing within industrial environments our entire careers. And we believe this depth of specialization within the venture capital asset class is now critical in order to compete given founders have a massive amount of funding options and are now looking to optimize with partners who truly understand their company’s specific markets and thus bring differentiated capital.

Finally, I like to say that if Mike Rowe and the Dirty Jobs crew would film it, and we can bring software into the equation to help those activities evolve into more productive, more efficient, and more profitable 21st century occupations that upskill our skilled heroes in this country, that’s where you will literally find us with our boots on scoping out opportunity.

What defines your portfolio?

Our $61M Fund 1 focuses on early stage venture capital investments in what we define as ‘digital industrial’ innovation across the construction, manufacturing, transportation, and energy & resources sectors. We started actively investing last year, and one key aspect to our portfolio is that all of the team’s we invest behind have both deep industrial domain and technical expertise they bring as a foundation to the problem they are trying to solve. These industrial markets are tough nuts to crack, and we look to back founders who have lived the pain themselves.

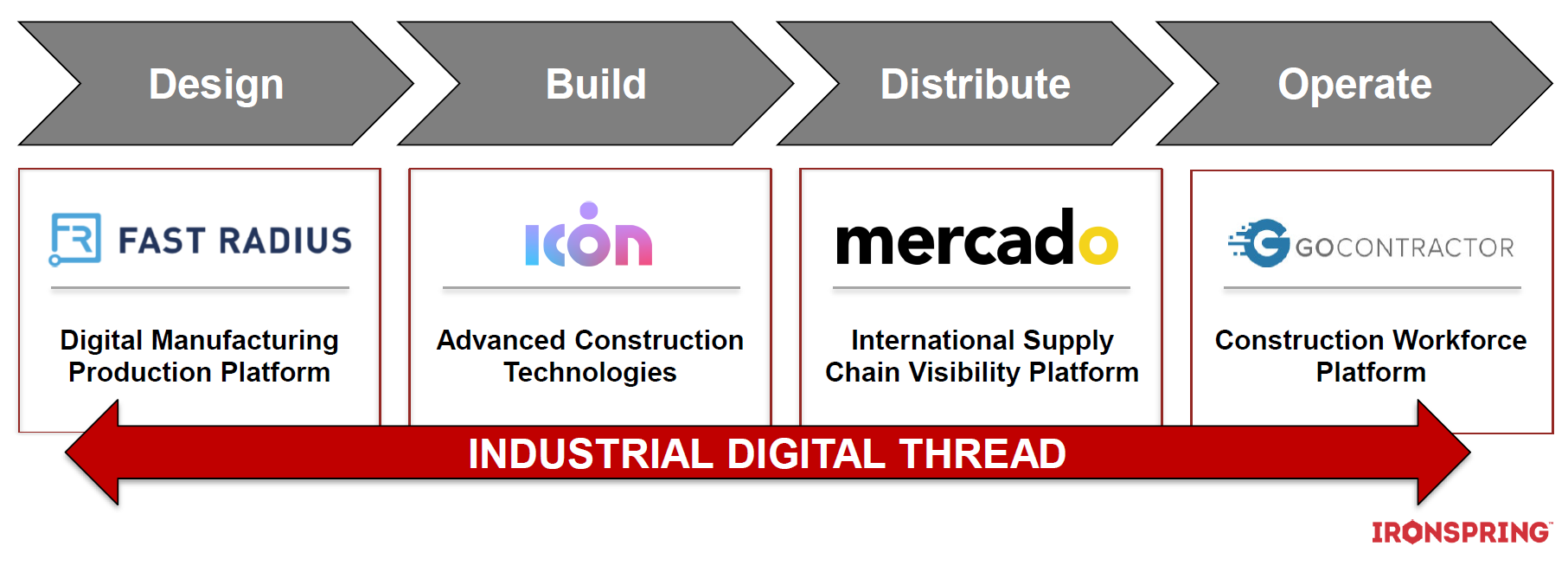

Below is a snapshot of how our portfolio companies diversify across the industrial value chain:

How is the firm different today than when you first started?

Although we just started investing out of our first fund last year, we’re excited to say that the initial ‘digital industrial’ thesis and fund construction strategy we set out on has really resonated in the market exactly where we thought there was a gap for sector-focused venture capital. We are only going to double down on our initial strategy, and aligned to that, the recent pandemic has only heightened the awareness for everyone that we need to modernize our global infrastructure. There has been no better time than now to do this, and I believe that the next decade will be defined by a wave of investment accelerating these legacy industries along their digital transformations.

Why is your firm a part of NVCA?

The engine of our economy and job creation is entrepreneurship, and the venture capital ecosystem plays a critical role providing the required capital to support those founders daring enough to make new things possible through technology. We joined the NVCA immediately upon forming Ironspring Ventures because we believe this organization is key to advocating, educating, and building community between the venture ecosystem and policy makers as to why we do what we do the way we do it.

Tell us about the current VC landscape in your geography/region.

Simply put, Austin, Texas where we are based is absolutely on fire with top talent, companies, and capital sources moving into town to join in on our welcoming, inclusive, and pro-business environment. It’s a very exciting time to be in the broader Texas innovation ecosystem right now, and it feels like a daily occurrence that national outlets are covering some news story related to this topic. And while we don’t have a specific Texas mandate with our investments, we are very bullish on this ecosystem and now have three investments in Texas across Austin, Dallas and San Antonio. All of our partners are Texas natives, and we couldn’t be more excited about the next decade ahead down here.

What’s ahead for your firm in 2021?

Our vision is to catalyze the adoption of ‘digital industrial’ solutions that will drive sustainability across the industrial value chain. So we will continue to follow the strategy we set out on to build a top-tier venture capital fund investing in passionate founders who share our vision to change the way our world designs, builds, distributes and operates daily. Again, we simply cannot afford to leave these legacy industries behind, and Ironspring Ventures will be here for the long haul to support that.

Describe your firm’s culture in 5 words or less.

Those would align to our Ironspring Ventures core values: Integrity, Collaboration, Innovation and Stewardship

(L to R: Ty Findley, Natan Reddy, Adam Bridgman, Peter J. Holt)

NVCA Member Spotlight is sponsored by American Express

New Exclusive Offer for NVCA members and their portfolio companies:

Spend $1,000 on eligible purchases within the first month after approval for a new Corporate Card Program, and receive $1,000 in statement credits. Terms apply. Get started.

https://nvca.org/wp-content/uploads/2019/06/42865ff45b916762c541e2bffe9fa791b4165a45.png

0

0

Devin Miller

https://nvca.org/wp-content/uploads/2019/06/42865ff45b916762c541e2bffe9fa791b4165a45.png

Devin Miller2021-03-24 10:03:452021-03-24 11:33:02NVCA Member Spotlight: Ironspring Ventures

As the Manager of Communications and Digital Strategy at NVCA, Devin plays a central role in NVCA’s communications operation, communicating with key constituencies in the entrepreneurial ecosystem as well as enhancing NVCA’s brand in Washington, D.C. Devin develops and executes on the organization’s communications and public relations strategies and creates media content to support them.