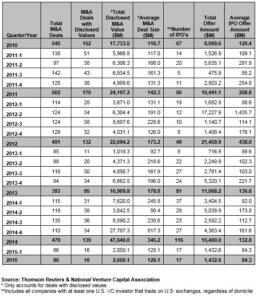

Number of Venture-Backed IPOs Falls below 20 for First Time since 2013

NEW YORK, NY – Seventeen venture-backed initial public offerings (IPOs) raised $1.4 billion during the first quarter of 2015, a 54 percent decrease, by number of offerings, from the first quarter of last year and a 58 percent decrease, by dollars, compared to a year ago, according to the Exit Poll report by Thomson Reuters and the National Venture Capital Association (NVCA). This quarter marked the first quarter to see less than 20 venture-backed IPOs since the first quarter of 2013. For the first quarter of 2015, 86 venture-backed M&A deals were reported, 16 of which had an aggregate deal value of $2.1 billion. Venture-backed M&A activity during the quarter fell to its lowest levels, by number of deals and disclosed value, since the first quarter of 2013.

“With such a blistering pace for venture-backed exit activity in 2014, it was only a matter of time before we saw a drop in activity. Despite the decline in venture-backed IPOs for the quarter, a lot of promising young companies made their debut on the public markets with many more waiting in the wings,” said Bobby Franklin, President & CEO of NVCA. “With 54 venture-backed companies having already filed publicly for IPOs and many more confidential registrations already in place, we are optimistic that the pace for venture-backed exits will pick up steam as the year moves ahead, creating opportunities for everyday investors to be shareholders of innovation.”

IPO Activity Overview

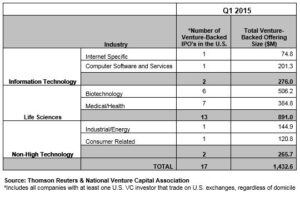

There were 17 venture-backed IPOs valued at $1.4 billion in the first quarter of 2015. By number of deals, quarterly volume decreased 54 percent from the first quarter of last year and registered a 58 percent decrease, by dollars, compared to the first quarter of 2014.

Led by the medical and biotechnology sectors, 13 of the 17 offerings during the quarter were life sciences IPOs, representing 76 percent of total listings in the first quarter.

By location, 13 of the quarter’s 17 IPOs were from U.S.-based companies. Two offerings came from Israel-based companies during the first quarter, including Solaredge Technologies (SEDG) which raised $144.9 million on the NASDAQ stock exchange on March 25th in the largest non-U.S. offering of the quarter.

In the largest IPO of the quarter, Box Inc (BOX), a Los Altos, California-based provider of cloud platform services, raised $201.2 million and began trading on the New York Stock Exchange on January 22nd. The company is currently trading 42 percent above its $14 offering price.

Twelve companies listed on the NASDAQ stock exchange during the quarter, four companies listed on the New York Stock Exchange and one listed Over-the-Counter.

Nine of the 17 companies brought to market this quarter are currently trading at or above their offering price. There are 54 venture-backed companies currently filed publicly for IPO with the SEC. This figure does not include confidential registrations filed under the JOBS Act, where many observers believe the majority of venture-backed companies now file.

Mergers and Acquisitions Overview

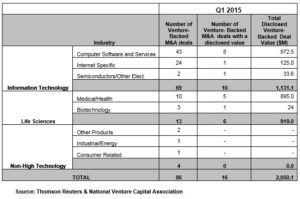

As of March 31st, 86 venture-backed M&A deals were reported for the first quarter of 2015, 16 of which had an aggregate deal value of $2.1 billion, the slowest quarter by disclosed deal value since the first quarter of 2013.

The information technology sector led the venture-backed M&A landscape with 69 of the 86 deals of the quarter and had a disclosed total dollar value of $1.1 billion. Within this sector, Computer Software and Services and Internet Specific deals accounted for the bulk of the targets with 43 and 24 transactions, respectively, across these sector subsets.

The largest venture-backed M&A transaction during the first quarter was Under Armour’s $475.0 million purchase of Myfitnesspal Inc. Catamaran Corp’s $260.0 million acquisition of Saint Petersburg, Florida-based Salveo Specialty Pharmacy Inc ranked as the second largest venture-backed M&A deal during the quarter.

Deals bringing in the top returns, those with disclosed values greater than four times the venture investment, accounted for 38 percent of the total disclosed transactions during the first quarter of 2015. Venture-backed M&A deals returning less than the amount invested accounted for 19 percent of the quarterly total.