WASHINGTON, DC – The National Venture Capital Association (NVCA) today released the 19th edition of the annual NVCA Yearbook, documenting trends and analysis of venture capital activity in the United States from the past year and capturing historical data and information about venture’s role in fueling entrepreneurship in America. The NVCA Yearbook is an annual publication based on data from Thomson Reuters that provides statistics on investments into startups, capital managed by general partners, commitments from limited partners and exit activity either thorough an initial public offering (IPO) or merger and acquisition (M&A).

“By every measure, 2015 was an extremely busy year for venture capital, with the total amount of capital invested into innovative startups reaching its highest level since 2000. From Florida to Texas and biotech to fintech, venture investors deployed capital to fund innovative startups in all corners of our country and across all sectors of our economy,” said Bobby Franklin, President and CEO of NVCA. “Writing the check was the easy part, though. The real work occurred behind the scenes, as venture investors rolled up their sleeves and toiled alongside the founders and CEOs to build the next generation of great American companies.

Industry Statistics

The activity level of the U.S. venture capital industry continued to increase in 2015 for the sixth consecutive year after the post-2000 low reached in 2009. In 2015, 718 firms each invested at least $5 million or more during the year, of which 238 invested in first fundings. Geographic location of firms remains concentrated with California-based firms managing 55% of the capital.

Commitments

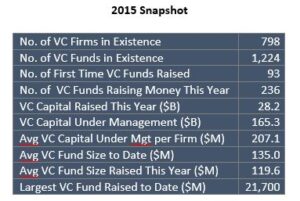

New commitments to venture capital funds in the U.S. totaled $28.2 billion in 2015, down slightly from the year before when the industry raised $31.1 billion for investment. Though this represented a 9% year-over-year decline, 2015 capital commitments were much higher than the $17.8 billion and $19.9 billion raised in 2012 and 2013, respectively.

Investments

Building on the strong fundraising environment in 2014, venture investors went to work in 2015, diligently deploying capital in the entrepreneurial ecosystem. Total investment for the year reached $59.1 billion, marking the highest amount deployed since 2000 and the second highest on record. Seed and early stage companies attracted 51% of all deals, with 1,444 companies raising venture funding for the first time. Entrepreneurs in 46 states and the District of Columbia raised venture capital funding in 2015, with California receiving the largest share of dollars deployed (57%) and deals (41%). Corporate venture groups deployed an estimated $7.7 billion into 930 deals, the highest investment total and deal count since 2000.

Exits

The 77 venture-backed IPOs in 2015 accounted for 42% of all IPOs last year, on par with 2013 and 2014. While there was a drop-off in venture-backed IPOs from 2014, 2015 was down only 4% compared to 2013 and up 60% and 54% from 2012 and 2011, respectively. Collectively, the 77 venture-backed IPOs in 2015 raised $9.4 billion and generated $58.8 billion in post-offer value, which was generated from $8.8 billion total venture investment in those companies. For the third straight year, biotechnology companies represented the majority of IPOs in 2015.

Click here to download the 2016 NVCA Yearbook.